“Demand for cash among the population continues to grow” – Central Bank

Citizens of Uzbekistan cash out more money, but at the same time they use terminals more often.

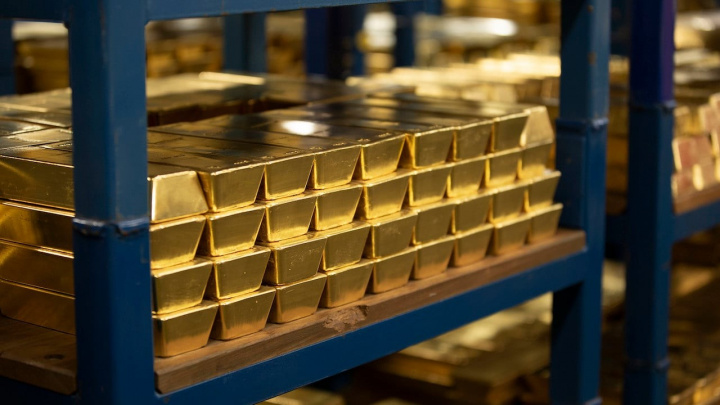

Фото: KUN.UZ

The turnover of cash in banks since the beginning of the year has reached 503 trillion soums. This is 39% more than the same period last year, Spot reported referring to the Central Bank.

For nine months, bank cash desks accepted 244.3 trillion soums in cash, or 36.7% more than last year. As before, their main part is provided by the collection of proceeds from the sale of goods and banking services.

Proceeds from the sale of goods increased by 27.5% – however, their share in the total income structure decreased slightly (39% vs. 41%). On the other hand, the inflow of money from banking services increased noticeably, and its share reached 34%.

The total income from trade and services reached 183.1 trillion soums. Of these, cash accounted for 62.6%, almost 2% less than last year. The share of terminals increased to 37.4%, and their absolute growth exceeded cash.

Cash consumption amounted to 258.6 trillion soums, having increased by 41.8% (76.2 trillion soums). In its structure, the share of withdrawing money from cards at ATMs continues to grow – from 37% last year to 41% now. The share of wages, on the contrary, fell from 9% to 8%.

The volume of cash withdrawals for 9 months increased by more than 1.5 times or by 38.6 trillion soums. In addition, banks spent 17 trillion soums (+35.6%) more to buy foreign currency in cash.

In total, 382.6 trillion soums have been credited to cards since the beginning of the year, which is almost twice as much as last year. Of this amount, 27.6% or 105.5 trillion soums were withdrawn in cash, mainly through ATMs.

To cover demand, the Central Bank issued 15.8 trillion soums in cash in nine months (including about 4 trillion in July-September). In total, 43.78 trillion soums of cash were in circulation at the beginning of October, with a total money supply of 174.16 trillion soums.

The share of cash in the money supply was 25.1%. The indicator rose to last year’s level (23.2%), but slightly decreased over the summer – in July it was 25.6%.

Recommended

List of streets and intersections being repaired in Tashkent published

SOCIETY | 19:12 / 16.05.2024

Uzbekistan's flag flies high on Oceania's tallest volcano

SOCIETY | 17:54 / 15.05.2024

New tariffs to be introduced in Tashkent public transport

SOCIETY | 14:55 / 05.05.2023

Onix and Tracker cars withdrawn from sale

BUSINESS | 10:20 / 05.05.2023

Latest news

-

Uzbekistan sees growth in foreign-invested companies, led by China and Russia

SOCIETY | 10:12

-

Citizens of Uzbekistan in the U.S. can no longer use old passports to return home

SOCIETY | 10:09

-

Broken promises: How 'Credit House' left buyers homeless

SOCIETY | 10:07

-

Uzbekistan moves forward with plans to bring back Tashkent trams

SOCIETY | 22:04 / 13.03.2025

Related News

19:24 / 11.03.2025

Central Bank purchases $100 million in US bonds in February

19:43 / 07.03.2025

Uzbekistan’s foreign exchange reserves hit a record $45 billion in February

20:04 / 05.03.2025

Uzbekistan becomes the world's largest gold buyer in January

17:02 / 01.03.2025