Uzbekistan to replace part of gold reserves with foreign bonds

Photo: The Balance

In early February, it was announced that Uzbekistan would reduce the share of gold in its foreign exchange reserves and buy US treasury bills instead. Then it was noted that diversifying the reserves is essential.

Now it became known that the Central Bank aims to replace the gold reserves not only with US treasury bills, but also with Chinese banknotes, Bloomberg reported.

“We want to buy U.S. paper and the debt of other countries, including China,” the Central Bank Governor Mamarizo Nurmuratov, 59, said in an interview in St. Petersburg, Russia. “The share of gold is near 50%, but in the future it can be lower.”

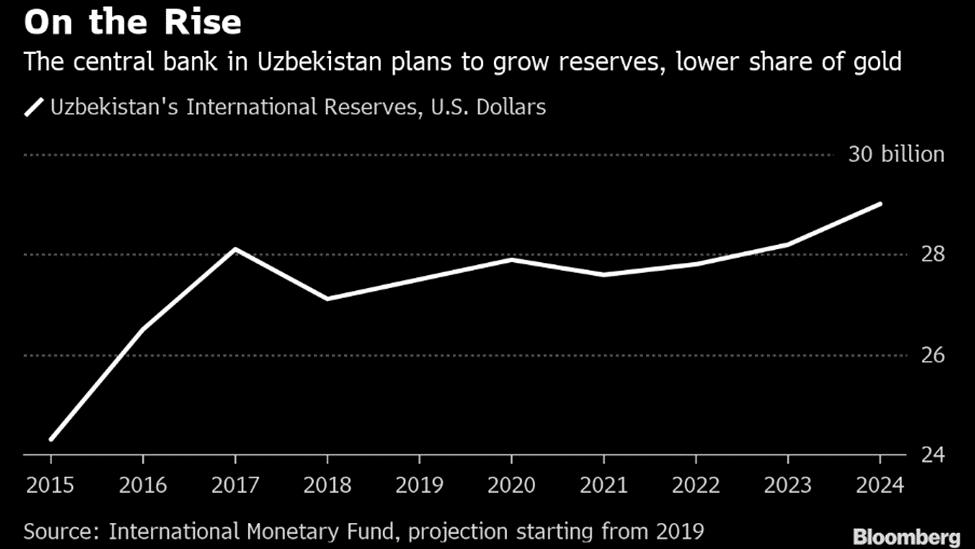

That’s at odds with the pattern elsewhere as policy makers from China to Poland snap up the precious metal to safeguard against the possibility of global recession and mounting geopolitical stress. While Uzbekistan currently scoops up all the gold produced locally and its holdings have been increasing in recent years, Nurmuratov’s reform plan envisages a shift to investing in the sovereign debt of other nations and a reduced share for the metal in the reserves.

“The share of gold will be smaller because the reserves will grow, and also because we’ll be selling more gold,” he said.

In four to five years, Uzbek producers should be able to sell directly to the global market, he said. For now, the Central Bank buys gold produced locally for soum and sells dollars in the currency market to offset the impact of purchases that can be about $350 million per month, according to Nurmuratov.

“We’re not supporting the soum exchange rate, not trying to smooth out swings,” Nurmuratov explained. “Our market participation isn’t an intervention to support the currency, it’s to offset gold purchases.”

Uzbekistan kicked off its bid to plug into the global economy in earnest in September 2017, when it allowed the local currency to tumble as much as 50% in a single day to match the black market rate against the dollar.

The soum has dropped more than 2% so far this year and traded little changed at 8,578.36 per dollar as of Thursday, July 11. Nurmuratov called the increased volatility “a necessary thing, part of a normal, healthy process.”

According to the International Monetary Fund, Uzbekistan must move on with liberalizing the economy after the “successful implementation” of its first steps. Next up are tax reforms, privatizations and overhauling the state-dominated banking industry, Nurmuratov said.

For a verdict on how the government is doing so far, he points to the country’s oversubscribed Eurobond debut in February. At one point the yield on the 2029 dollar notes was down more than 100 basis points since its sale. It traded up one basis point at 4.64% on Thursday.

“The placement showed us how investors rated our reforms,” Nurmuratov stated. “In our opinion, we got high marks.”

Related News

16:22 / 16.02.2026

Central Bank reports 24 percent rise in cash turnover

19:06 / 12.02.2026

Uzbekistan’s currency gains nearly 7% against dollar, easing external debt payments

16:06 / 11.02.2026

Export revenues and remittances drive currency market surplus in Uzbekistan

16:09 / 09.02.2026