Central Bank: Demand for soum loans fell almost twice in 2019

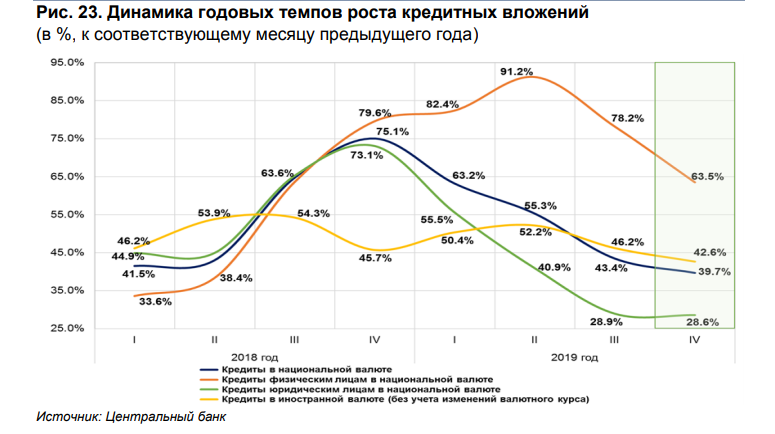

In 2019, the growth rate of loans in the national currency slowed down almost twice (from 75.1% in the IV quarter of 2018 to 39.7% in the IV quarter of 2019), the Central Bank of Uzbekistan reported.

At the end of 2019, lending to the economy grew by 73.8 trillion soums, or 54.8%. The main sources of credit investments were centralized funds, the active development of foreign credit lines by banks, as well as funds from the allocation of sovereign and corporate Eurobonds.

By the end of 2019, there was a decrease in the annual growth rate of loans in national currency for individuals and business entities to 63.5% and 28.6%, respectively. At the same time, the growth rate of loans in foreign currency remained more stable, 45.7% in 2018 and 42.6% in 2019.

An analysis of the structure of loans in foreign currency shows that the propensity of the private sector to finance investment projects at the expense of foreign currency loans is mainly due to the relatively high interest rates on soum loans.

In particular, in 2019, economic entities received loans worth $6.2 billion. As for loans in the national currency, the gradual balancing of their growth rates in the last quarter of 2019 was “due to strengthening of prudential supervision measures, optimization of budget expenditures, as well as maintaining the refinancing rate at 16% per annum, which ensured relatively tight monetary credit conditions.”

“If there are significant differences in external and internal monetary conditions, the effective implementation of an appropriate monetary policy has been difficult, mainly due to the growing attractiveness of external funding sources,” the Central Bank said.

According to the regulator, this situation indicates an increasing need for coordination of efforts in the field of monetary and macroprudential policy. In this regard, the Central Bank is moving towards the active application of approaches to macroprudential support of decisions made in the field of monetary policy.

Related News

20:24 / 20.02.2026

Central Bank survey shows downward trend in public inflation expectations

18:00 / 18.02.2026

Inflation expectations in Uzbekistan drop to 11.2% as January optimism returns

10:54 / 17.02.2026

Annual inflation in Uzbekistan slows to 7.2 percent

16:22 / 16.02.2026