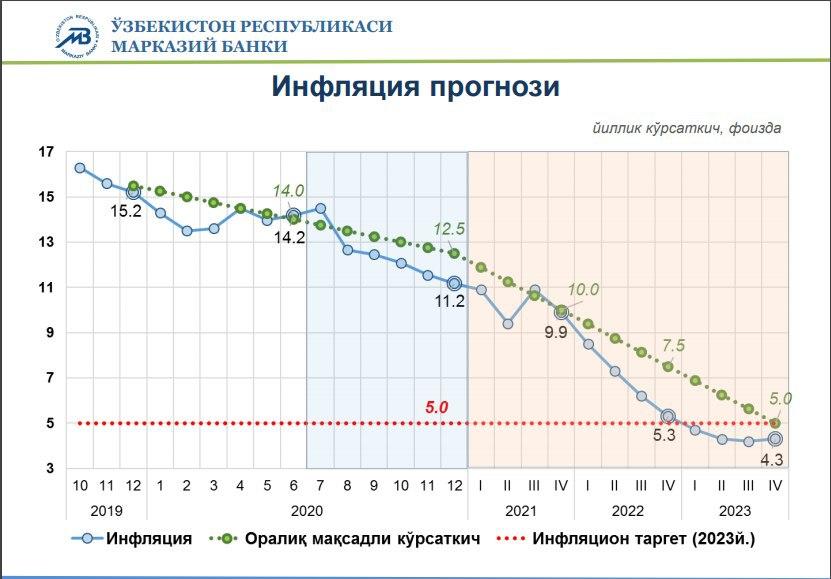

Central Bank announces its inflation forecast for 2020

The inflation forecast for the year will remain unchanged at 11-12.5%, noted at the CB Board meeting. The bank will work with the government to take all necessary measures to achieve it.

Photo: Getty Images

Inflation and inflation expectations

The CB notes that in the first quarter of this year, the annual inflation rate was lower than the target trajectory. This was mainly due to the strict fiscal policy pursued at the time, the balanced level of lending to the economy, and the fact that regulated prices remained unchanged.

Since the second quarter, the inflation rate has risen slightly compared to the previous quarter and at the end of June, it amounted to 14.2%. Factors such as high demand for food and construction materials and a seasonal decline in fruit and vegetable prices in June were exacerbated by rising prices in the second quarter of this year.

Reportedly, core inflation in the second quarter had a relatively high growth rate, reaching 13.8% year-on-year in June.

Inflation expectations of the population and business entities for the next 12 months showed a significant decline in May-June after the high growth in April this year. At the same time, inflation expectations are being formed significantly higher than the trajectory of the inflation target.

According to the survey, respondents attribute the rise in prices in the coming months, primarily to the impact of the pandemic and the rise in prices for monopolistic goods and services.

Economic activity

According to the State Statistics Committee, in the first half of this year, real GDP in the country increased by 0.2%.

At the same time, consumer goods production, agriculture and construction were the main drivers of growth, investment and foreign trade turnover slowed down, while the 6-month foreign trade turnover decreased by 18.2% compared to the same period last year.

After a decline in economic activity in March-April this year, a gradual recovery trend is observed in a number of economic development indicators in May-June.

In June, the total volume of transactions through the bank payment system increased by 39% and 30%, respectively, compared to March and April. In the field of trade and paid services, there was an improvement in the dynamics of growth of cash inflows. In particular, after a sharp decline of 34.8% (from 11.4 trillion soums to 7.5 trillion soums) in April compared to the previous month, the volume of trade and other income increased by 33.8% in May and 25.3% in June and amounted to 12.6 trillion soums.

Monetary conditions

In the second quarter of 2020, relatively moderate tight monetary conditions were maintained. In the interbank money market, a positive spread (difference) of interest rates on time deposits for up to two weeks with the base rate was formed.

Interest rates on deposits in the national currency were relatively stable and showed growing dynamics. At the end of June, the average weighted interest rates on time deposits of individuals amounted to 20%, and on-time deposits of legal entities – 17%.

The decrease in interest rates on loans in national currency from 25.8% at the beginning of the year to 23.7% in June is explained by the transfer of additional liquidity to commercial banks during the pandemic to purchase housing and lending to businesses under government programs.

The dynamics of the national currency exchange rate were formed under the influence of the deterioration of the general situation in the world economy, the decline in foreign exchange earnings and the devaluation of the national currencies of major trading partners. As a result, in April this year, the exchange rate depreciated by 5.8%. In May-June, the exchange rate was relatively stable, with a devaluation rate of 0.4%.

Inflation forecast

Given the current situation in the economy and the level of uncertainty associated with the pandemic, the CB kept the inflation forecast for 2020 unchanged at 11-12.5% per annum.

As long as the demand for basic foodstuffs and medicines remains high in the context of long-term maintenance of quarantine measures, the demand for non-primary products will decrease as a result of redistribution and optimization of expenditures of the population.

In addition, as a result of further extension of quarantine restrictions, restrictions on the movement of labor resources, the deterioration of the logistics system, and the increase in the time and cost of transporting goods may have an increasing effect on the prices of basic goods.

In January-June this year, lending to the economy increased by 18.2% (38 trillion soums), money supply – by 12.3% (11.2 trillion soums), these were the factors driving up core inflation significantly higher than the budget revenues in the second quarter. Overall, core inflation is expected to be around 12% by the end of the year.

With the intensification of anti-pandemic measures and the increase in healthcare costs, the pressure on the budget and centralized funds will continue in the second half of the year, which will lead to a significant increase in the overall fiscal deficit above the forecast.

According to preliminary estimates, as a result of the recovery of economic activity and measures taken to support key sectors of the economy, positive GDP growth is expected in the second half of the year and real growth will reach 1.5-2.0% by the end of the year.

Risks and uncertainties

One of the main risks in the coming periods is the rapid change in the economic situation as a result of the impact of the pandemic and the measures taken to prevent it.

This leads to high levels of uncertainty in the economy, making it difficult to predict economic processes in advance, and consequently significantly reducing the accuracy and efficiency of forecasts.

At the same time, the pressure on inflation remains due to monetary factors, in particular, the sharp increase in lending to the economy. This, in turn, requires measures to balance credit growth rates and increase the return on previously allocated loans.

In addition, the long-term recovery of economic activity in our major trading partners and the maintenance of an unfavorable price environment in world markets may lead to a certain reduction in foreign exchange earnings from exports and cross-border remittances.

The Central Bank will continue to study the nature of the factors and risks of inflation under the influence of external and internal conditions and will make appropriate decisions on the base rate based on the formation of inflation forecast dynamics.

Related News

16:06 / 11.02.2026

Export revenues and remittances drive currency market surplus in Uzbekistan

15:56 / 11.02.2026

Higher gold revenues help Uzbekistan cut 2025 fiscal gap to 2.1% of GDP

16:09 / 09.02.2026

Cashless transactions surge as bank card usage rises across Uzbekistan

12:01 / 09.02.2026