Central Bank leaves interest rate unchanged at 14 percent per annum

According to the official release, in 2024, the inflation rate is expected to be in the range of 8-9 percent.

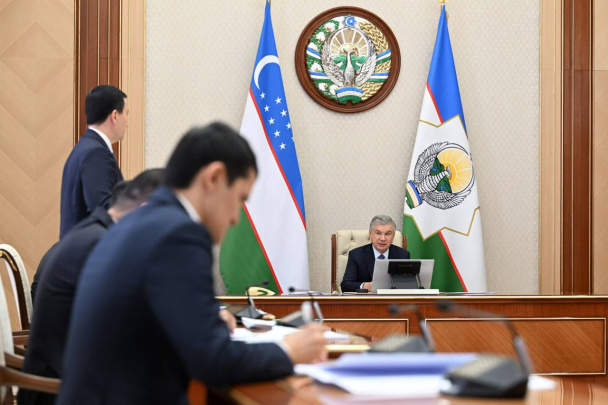

Photo: Central Bank

At the meeting of the Central Bank Board on December 14, 2023, a decision was made to leave the interest rate unchanged at the annual level of 14 percent.

"Despite the slowing down of inflationary processes in the economy, uncertainty remains regarding the duration of this trend. In the conditions of high gross demand, the task of reducing inflation to the target level of 5 percent in 2025 requires the continuation of relatively strict monetary and credit conditions," the official release of the Central Bank says.

It is noted that the inflation rate decreased in October-November and was 8.8 percent in annual terms.

According to forecasts, in 2024, the inflation rate is expected to be in the range of 8-9 percent given the current economic conditions. Although core inflation showed a slowing trend since the beginning of the year and reached 9 percent annually in November, the effect of increasing pressure on some goods is observed. Achieving a steady decline in inflation will take some time.

Inflationary expectations of the population and entrepreneurs continue to be higher than the current inflation indicators, around 13-14 percent.

Economic activity is mainly supported by high aggregate consumer demand and growth in private investment. Consumer demand is supported by government spending and an increase in retail lending. The driver of supply-side economic growth remains the services sector, which accounts for about half of GDP growth. Preservation of positive dynamics of growth of wages and real income of the population will support consumption activity in the future. The above-mentioned factors show that the risks associated with ensuring a stable decrease in inflationary processes remain.

"The Central Bank management has decided to continue a relatively tight monetary policy in order to achieve the inflation target under these circumstances," the release said.

In the case of decreasing inflation, keeping the main rate unchanged will serve to keep the real interest rates in the money market moderate. This will help to preserve the current dynamics in the accumulation activity in the conditions of the balancing of lending rates and increase the possibility of wider use of domestic financial resources against the background of the increase in the cost of external financing.

In the conditions of high real interest rates on deposits in national currency, high growth rates of bank deposits are expected to continue.

In the future, the achievement of long-term price stability will become more and more relevant due to the reduction of the budget deficit and the expansion of the scale of application of market principles to the economy.

Related News

12:50 / 21.02.2026

President Mirziyoyev backs extension of tax relief to accelerate Karakalpakstan’s industrial growth

20:24 / 20.02.2026

Central Bank survey shows downward trend in public inflation expectations

18:00 / 18.02.2026

Inflation expectations in Uzbekistan drop to 11.2% as January optimism returns

20:44 / 17.02.2026