How to use paid subscriptions and save money

Payment apps have become the main way to transfer money to family members and pay rent and utility bills. The fee for P2P transfers is usually around 1%, which, with monthly transfers of 5–7 million sums, can add up to as much as 70,000 sums in fees on transfers alone.

Paid subscription plans promise to reduce these costs by waiving part of the commission, returning money through cashback, and adding extra services — from streaming platforms to telemedicine.

Kun.uz decided to examine when it makes sense to subscribe to paid plans in payment apps. For this review, we selected several popular services: Click Premium, Payme Plus, TBC Plus, and Hambi Smart. The article looks at the features of these subscriptions, the real savings on commissions and cashback, as well as the key terms and conditions users should consider before subscribing.

What subscription plans are available

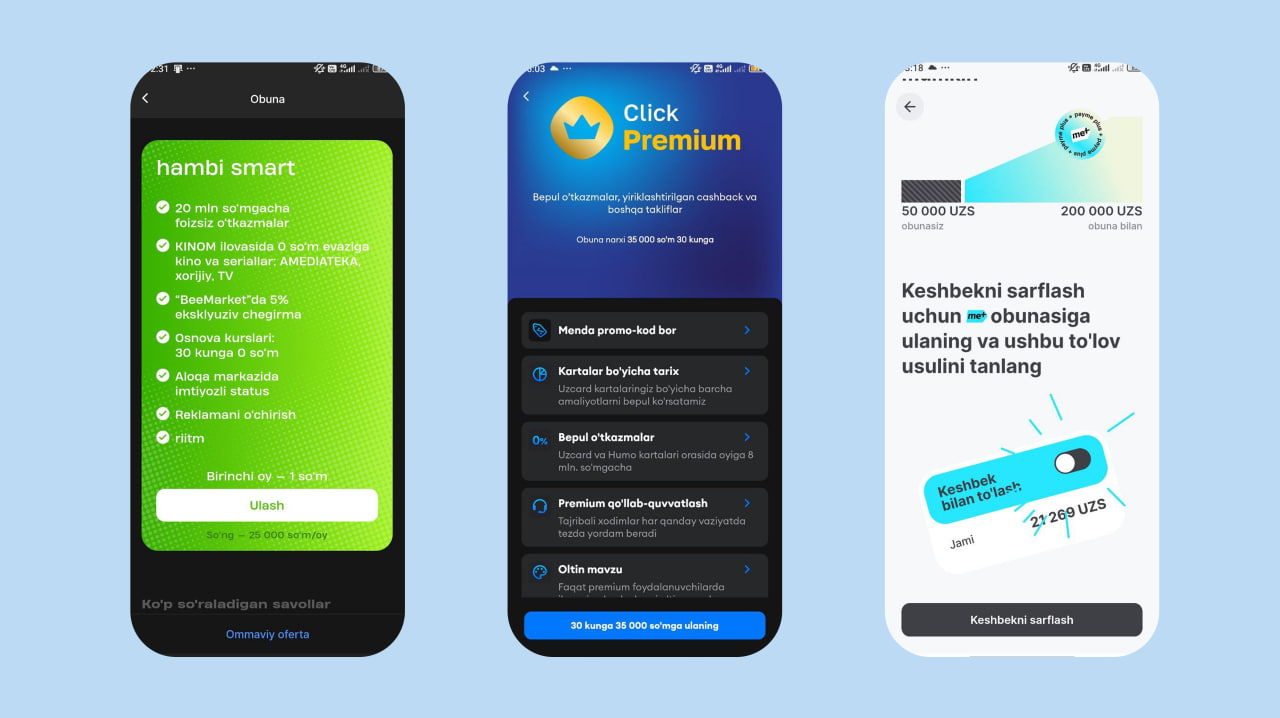

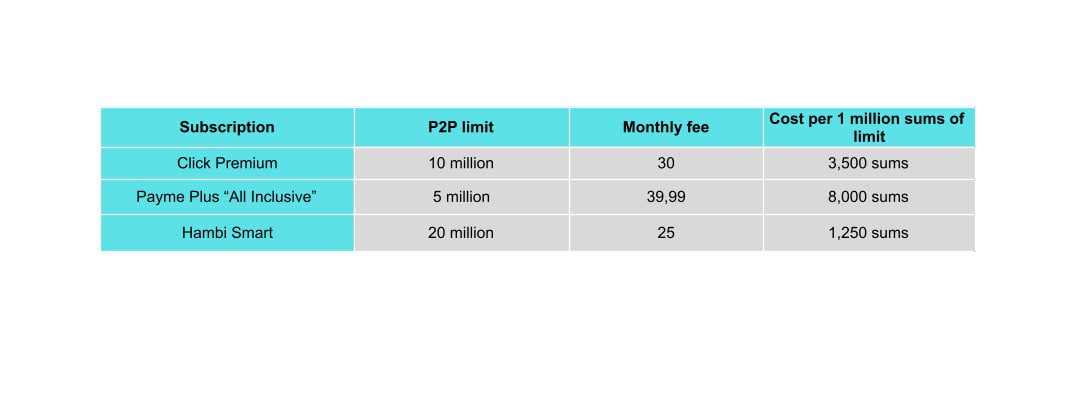

Click Premium — 35,000 sums per month, P2P transfers up to 10 million sums with no commission.

Payme Plus — 39,990 sums per month for the “All Inclusive” plan, P2P transfers up to 5 million sums with no commission. There is also a “Basic” plan and a separate “Monitoring” service priced at 4,990 sums.

Hambi Smart — 25,000 sums per month, P2P transfers up to 20 million sums with no commission.

TBC Plus — 29,999 sums per month, cashback of up to 5% at partner merchants and around 1–2% on all purchases.

The Payme team shared analytics on user behavior: 40% of subscribers choose the “Monitoring” service priced at 4,990 sums per month, which provides spending analytics only, without P2P transfers or cashback. About 10% opt for the full “All Inclusive” package — users who actively use the app and clearly understand what they are paying for. The “Basic” plan remains a niche product, accounting for roughly 1% of subscribers.

How to save on transfers

This is the core feature of all subscription plans.

In terms of the limit-to-price ratio, Hambi Smart offers the lowest cost per 1 million sums of P2P limit.

Payme’s analytics show that subscribers make transfers 2–3 times more frequently than users without a subscription. This does not necessarily mean they transfer larger total amounts, but they do make more individual transactions. Most users utilize only part of their available limit; the full limit is typically used by those who have regular large transfers.

Most common scenarios:

- regular transfers to family members and parents;

- everyday payments to individuals: rent, service providers, shared expenses;

- pooling money in small groups — friends or colleagues.

Click Premium’s terms state that if the remaining P2P limit is exceeded, the commission is charged on the full transfer amount, not just the excess. For example, if 2 million sums remain in the limit and a user transfers 3 million sums, a 1% commission will be charged on the full amount — 30,000 sums, not 10,000.

Payme and Hambi do not have this condition: once the limit is exceeded, transfers are processed under standard terms. In all services, commission-free transfers apply only to Uzcard and Humo cards.

How much cashback you can get

Cashback works differently across subscription plans.

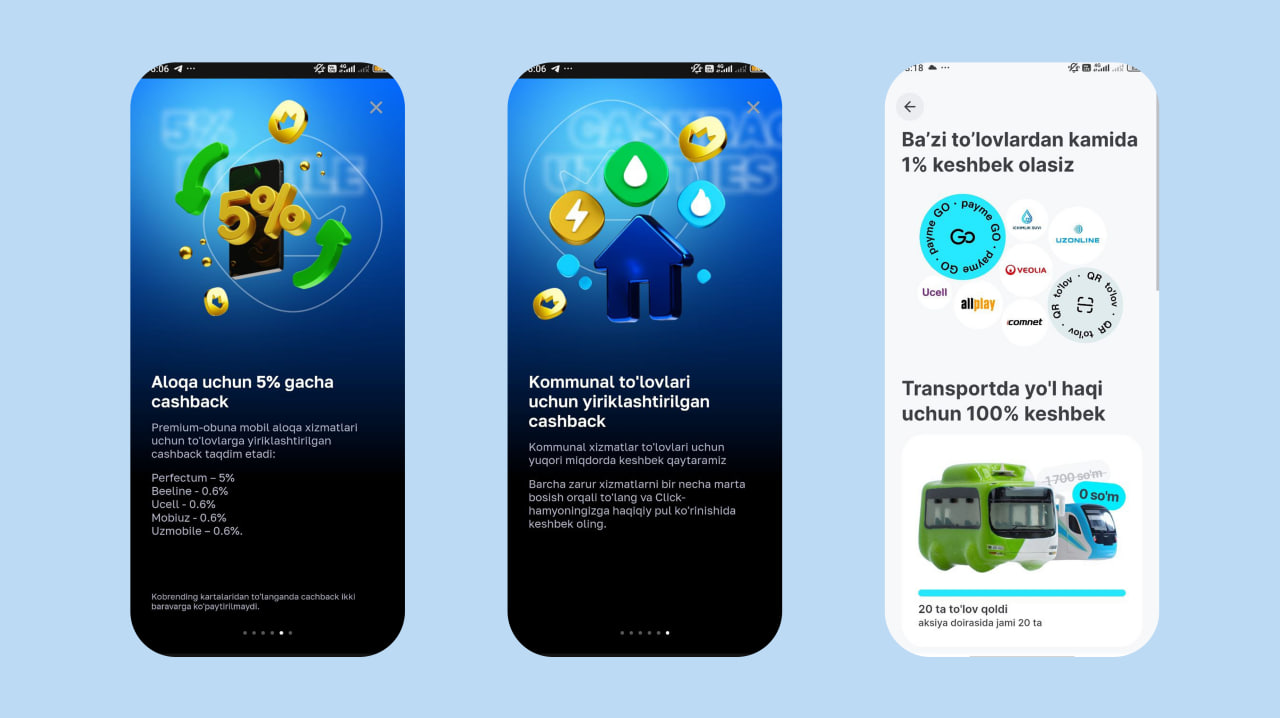

Click Premium

Click Premium offers cashback on mobile top-ups, utility payments, and selected purchases. Cashback is credited to the in-app Click wallet and can be withdrawn to a card or used for other payments.

Cashback rates vary by category:

- Perfectum — 5%

- Beeline, Ucell, Mobiuz, Uzmobile — 0.6%

- Utility services — higher cashback rates

- Purchases made with Click-branded cards — up to 4%

Cashback is credited to the Click wallet and can be withdrawn to a card or used for other payments. According to the terms and conditions, cashback is not applied to certain transactions, including taxes, fines, loan repayments, railway tickets, charitable donations, and recurring payments.

Payme Plus

Payme Plus offers 1% cashback on most payments — it applies to more than 90% of transactions and covers several thousand merchants. When a payment is made using cashback, no new cashback is earned. If a transaction is refunded, any previously credited cashback bonuses are deducted.

Promotional cashback rates are available until December 30, 2025:

- Metro and bus fares — 100%

- Utility services — 3% (gas, electricity, water, waste collection)

After the promotion ends, the base cashback rate of 1% will remain in place, while higher promotional rates may change. Current terms and conditions should be checked in the app.

TBC Plus

TBC Plus is a recently launched subscription and a product that stands out in the local market. The service provides access to added-value features within the bank’s ecosystem, including cashback, a loyalty program, and enhanced app functionality.

What TBC Plus includes:

- 1% cashback with Salom Card on payments made at physical terminals — in cafés, shops, and other points of sale — up to 500,000 sums per month.

- With a Salom Visa card, cashback is cumulative: 1% from Visa + 1% from TBC Plus, resulting in 2% cashback per purchase. At Salom Card partner merchants, cashback reaches 5%.

- Hisob-Kitob — full transaction history, management of all cards, detailed spending analytics, and convenient budgeting tools.

- More rewards — double the number of stars for payments in the TBC Stars loyalty program and higher limits in the TBC Friends referral program (30,000 sums for issuing a Salom Visa card or 10,000 sums for activating TBC Plus, paid for the first 5–10 referrals).

- Yandex Plus — movies, music, and podcasts bundled into one subscription.

- Free coffee at Safia every week — considering the subscription costs 29,999 sums per month, frequent coffee drinkers can offset the full cost with just one free drink per week.

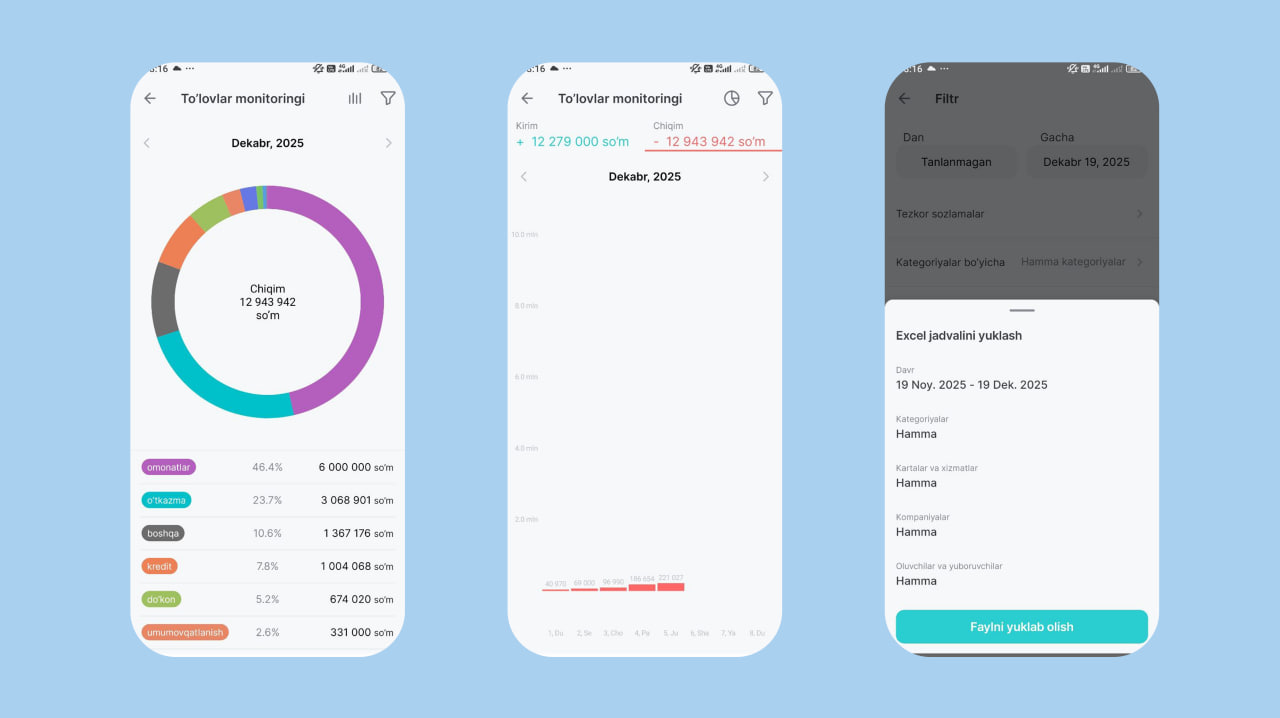

How you can track your spending

- All four subscriptions allow users to view their card transaction history, but the range of features differs.

- Click Premium provides card transaction history, reports, and filters. Without a subscription, the monitoring feature costs 4,500 sums per month.

- Payme Plus shows spending categories and charts and allows data export to Excel. Monitoring is included in all plans and is also available as a standalone service for 4,990 sums per month.

- Hambi Smart offers basic spending monitoring through the app.

- TBC Plus includes Hisob-Kitob Plus, which provides access to full transaction history, spending analytics and categorization, and budgeting tools.

Payme’s data shows that the most frequent action in the app is checking the account balance, followed by opening the spending monitoring section. Users return to this feature on a regular basis.

The standalone “Monitoring” service has become the most widely used product within the Payme Plus lineup: around 40% of subscribers choose this option. For users with a relatively low volume of transfers, spending monitoring may be the main reason for subscribing.

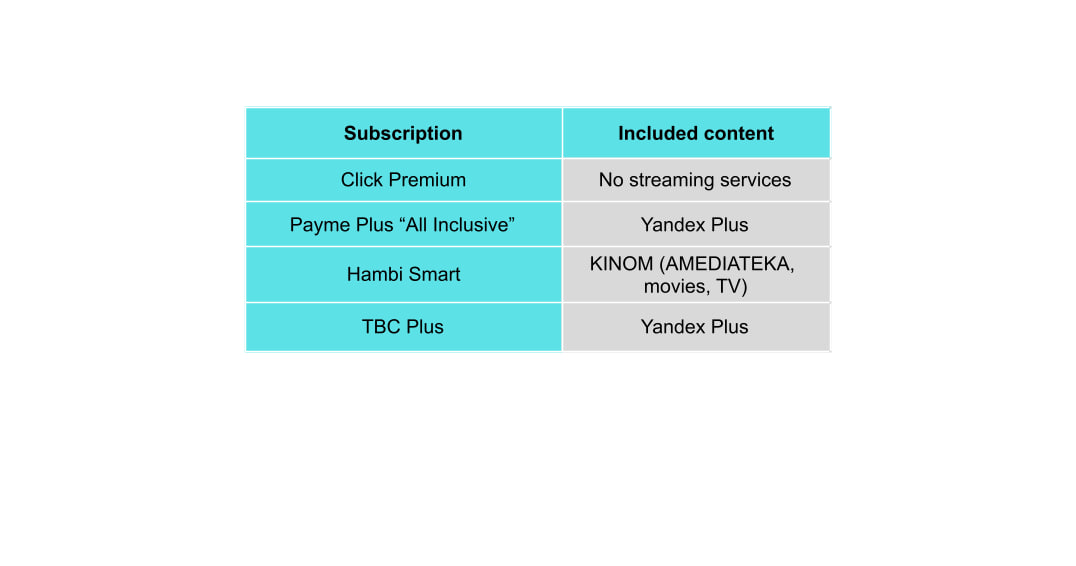

What content is included with subscriptions

Subscriptions differ in the type of content they offer.

Yandex Plus

Payme Plus “All Inclusive” includes a full Yandex Plus subscription. It offers:

- Kinopoisk — movies, TV series, and Kinopoisk Originals;

- Yandex Music — ad-free music streaming;

- Yandex Books — audiobooks and e-books;

- Yandex Plus cashback points — earned on purchases within Yandex services and redeemable for taxi rides, food delivery, and marketplace purchases;

- Discounts across Yandex services — Yandex Taxi, Yandex Food, Yandex Market, and Yandex Travel.

As a standalone product, Yandex Plus costs from 9,999 sums per month.

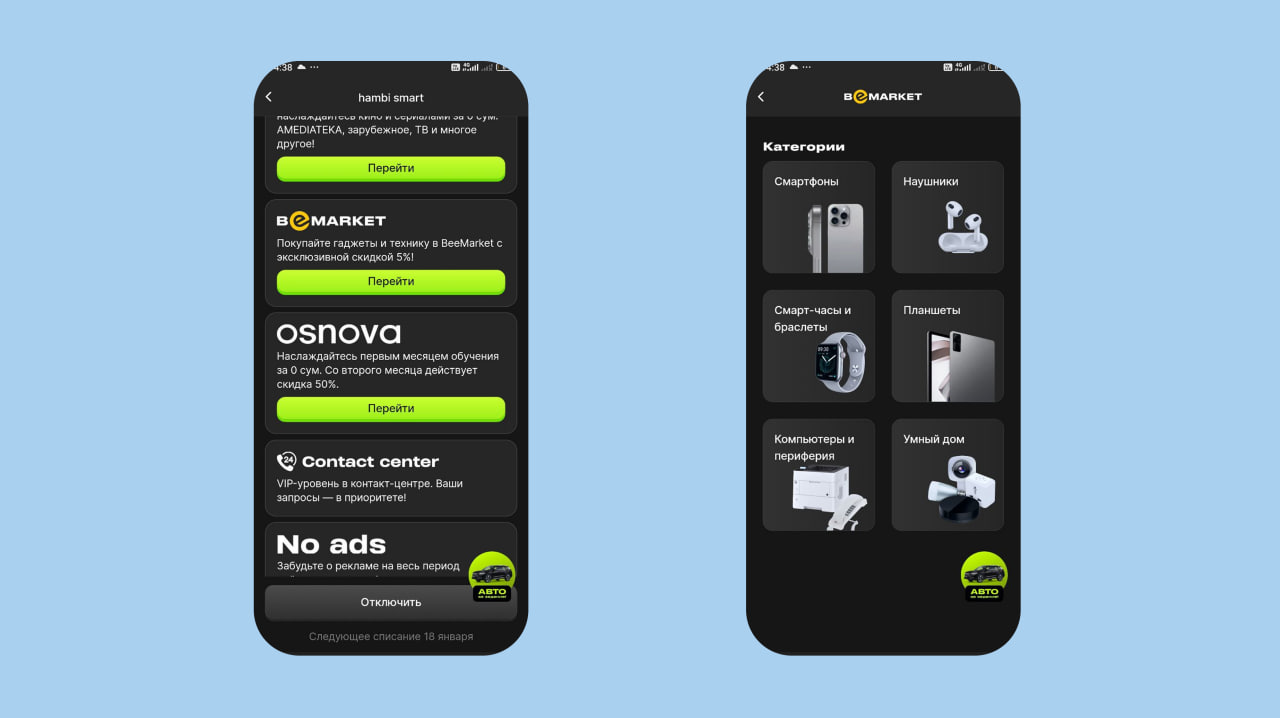

KINOM with Hambi Smart

Hambi Smart includes a KINOM subscription, which provides access to:

- AMEDIATEKA — HBO series, new movie releases, and TV shows;

- Uzbek movies and TV series;

- TV channels.

When a subscription pays off — and when it doesn’t

Whether a subscription delivers real savings depends on how actively a user takes advantage of the features included.

Click Premium becomes cost-effective when monthly transfers exceed 5 million sums — at that point, savings on commissions are comparable to the subscription fee. Additional benefits include withdrawable cashback and higher cashback rates on mobile services and utility payments.

TBC Plus is built around cashback: 1% back on all card purchases. It pays off if you spend 3–4 million sums or more per month using a Salom Card. Additional benefits include free transfers and priority customer support.

Payme Plus “All Inclusive” is worthwhile if you regularly use several features at once — commission-free transfers, payments, and streaming services. This subscription is best suited for users who rely on Payme for everyday tasks rather than opening the app once a month.

Hambi Smart offers the highest P2P transfer limit at the lowest price, making it attractive for users who transfer 20 million sums or more per month. Additional benefits include access to KINOM and discounts at BeeMarket.

Payme’s analytics highlight two typical scenarios in which a subscription becomes cost-effective:

- You frequently transfer money and exceed free limits — in this case, savings on commissions offset the subscription fee.

- You actively use the included benefits — cashback, streaming, spending monitoring — and the total value exceeds the monthly cost.

Conversely, a subscription tends to be unprofitable if:

- You make only one or two transfers per month and rarely open the app.

- You subscribe to a full package but use only basic features — for example, you don’t use streaming services or activate cashback.

According to Payme, a common mistake among users is subscribing without properly setting up cards and services, as well as losing accumulated cashback due to inactivity in the app.

What to check before subscribing

- Calculate how much you transfer each month and how much you pay in P2P fees. If the total is below 3–5 million sums, savings on commissions may be lower than the subscription cost.

- Decide whether you will actually use streaming services and additional features. If you don’t need the content, that part of the package will become an unnecessary expense.

- Review the terms and conditions carefully: how commissions are calculated when limits are exceeded, whether refunds are available, and within what timeframe you can submit a request.

- Check the cashback terms: where it is credited, whether it can be withdrawn, and when it expires.

- Take advantage of trial periods: Payme offers 30 days free, while Hambi charges 1 soum for the first month.

- At the end of the month, review your usage statistics: how much you saved on commissions and cashback, and which features you actually used.

Related News

15:06 / 05.12.2025

Energy Ministry distances itself from HGT gas-monitoring app after ownership controversy

12:17 / 08.07.2023

Threads becomes leading downloaded app in recent days in Uzbek App Store

15:34 / 03.06.2022

Statistics Committee provides data on the number of mobile subscribers in Uzbekistan

13:38 / 14.12.2021