Fitch evaluates upcoming bonds of Uzbekistan

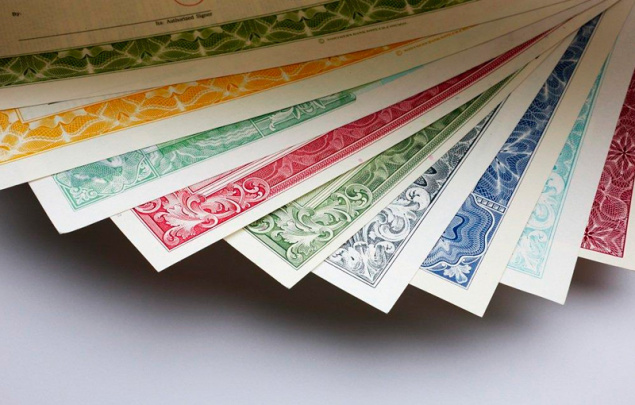

Fitch Ratings assigned an expected BB-(EXP) rating to the upcoming unsecured bonds of Uzbekistan in foreign currency. This is stated on the agency’s website.

The final rating will be known after receiving the concluding documentation and it should correspond to the information received earlier.

The assigned rating at the agency is explained by the fact that it corresponds to the long-term foreign currency rating of Uzbekistan, which Fitch assigned at the end of December 2018.

The agency notes that the bond rating is sensitive to changes in the long-term issuer default rating (IDR) of Uzbekistan in foreign currency.

Uzbekistan will issue eurobonds for a period of 5 to 10 years. On February 7-14, road shows will be held in New York, Boston and London. Negotiations with major investors are expected during the event. Following the meetings, first steps will be taken to integrate with international financial markets.

JP Morgan, Deutsche Bank, Citi and “Gazprombank” will deal with the historical release. It is expected that release of the first dollar bonds will allow the country to gain a foothold on the map of international investors. Top managers of leading companies in the world express enthusiasm and readiness to buy bonds.

Related News

18:52 / 19.01.2023

Fitch Ratings assigns JSC Thermal Power Plants international rating “BB-”; Outlook stable

19:20 / 24.02.2022

Non-residents and individuals allowed to buy government bonds

15:49 / 26.01.2022

Uzbekistan for first time issues bonds with a maturity of 10 years

21:48 / 05.10.2020