Income tax rate expected to increase in 2020

Income tax rates are expected to increase in 2020. This is stated in the project “Budget for citizens in 2020”.

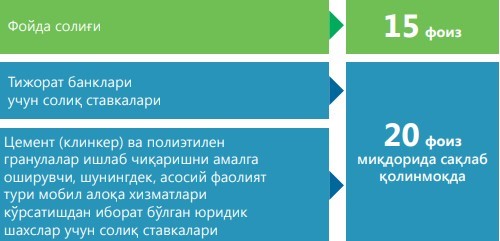

At present, the rate remains at 12%, and in the next year, it is expected to raise up to 15%. Tax rate for commercial banks and tax rate for legal entities engaged in the production of cement (clinker) and polyethylene granules, as well as mobile communication services, are kept at 20%.

According to the budget bill, the rate of income tax in Belarus is at 18%. In Kazakhstan - 20%, Russia - 20%, Tajikistan - 23%, Kyrgyzstan - 10%, Georgia - 15%.

In Belarus, total tax burden on investor is at 28.7%, in Georgia - 19.3%, in Kazakhstan - 24%, in Kyrgyzstan - 10%, in Russia - 30.4%, in Tajikistan - 32.2%. So, it is at 16.4% in Uzbekistan (in 2019) and it is expected to be 19.3% in 2020.

Related News

15:48 / 27.02.2026

Uzbekistan zero rates VAT at Termez trade hub to boost exports

12:04 / 27.02.2026

Uzbekistan to streamline tax administration with unified payment system

17:14 / 24.02.2026

Nearly 12,500 tax violation reports filed in one month – UZS 3 billion paid to reporting citizens

07:33 / 21.02.2026