Central Bank allocates 30 trillion soums to keep production enterprises in business

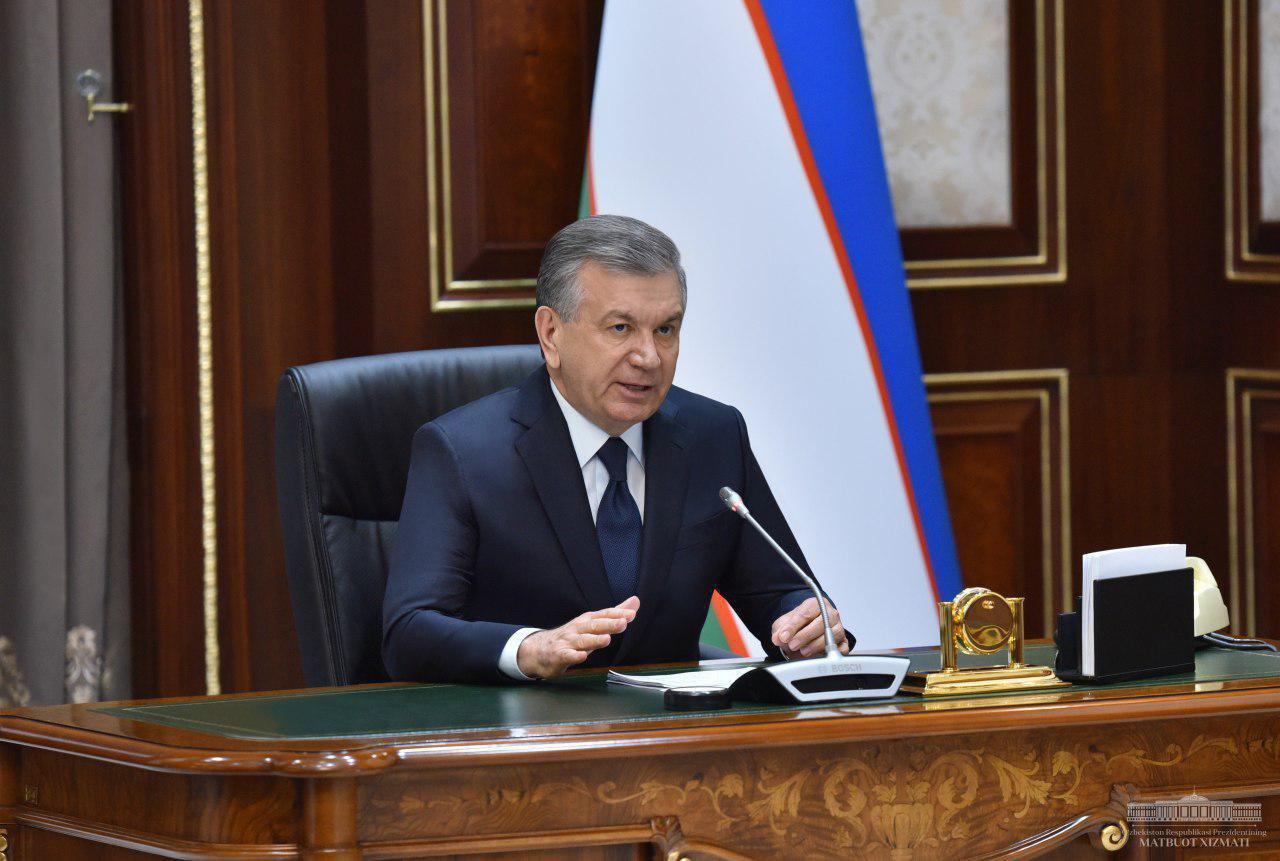

President Mirziyoyev chaired a video conference on the issues of ensuring the stability of banks. Participants of the meeting noted that it is necessary to provide loans to enterprises for the salary payment.

Photo: Press service of the President

On April 9, President Shavkat Mirziyoyev held a meeting on ensuring the stable functioning of the banking system and financial support to the economy during the coronavirus pandemic.

“During the coronavirus pandemic, we are taking all measures to support the population, and preserve sectors of the economy and businesses. The decrees the President adopted on March 19 and April 3 set many privileges and preferences in this regard.

In particular, the repayment of loans to entrepreneurs and the population totaling 19.5 trillion soums will be delayed until October 1. Undoubtedly, this will be a great help for them considering the current conditions. However, we should not ignore the fact that financial institutions receive less money.

Therefore, participants discussed the issues of ensuring the stable operation of banks, employment and income generation at the meeting,” the presidential press service said.

Given the world economic crisis, the project portfolio of banks will be critically reviewed.

It is necessary to identify long-term projects that have not yet begun and replace them with new projects that will begin to give results this year.

In this regard, banks were advised to prioritize funds for small businesses to create new jobs and support self-employment.

This year, 4 trillion soums will be allocated for employment programs through Agrobank, Xalq Banki and Microcreditbank. Also, an additional 500 billion soums will be allocated to the State Fund for Supporting Entrepreneurship through the Anti-Crisis Fund.

“These funds will be the basis for many new projects. First of all, the President stressed the necessity of prioritizing food security, agriculture, healthcare, small business and handicraft projects.

Considering that the work in the agricultural sector has not stopped even during the quarantine period, it was noted that commercial banks related to the agricultural sector should increase the number of new projects.

It is known that last week, 24 banks took the initiative and announced credit holidays for individuals. During yesterday’s meeting, the banks were encouraged to propose more initiatives that are favorable and inspire mutual respect among the population.

For example, it will be more convenient for the population sitting at home during the quarantine, if the term of expired deposits is extended and this is announced in the media.

Once the quarantine is over, many businesses will need a lot of time and money to resume operations. Therefore, the Central Bank was instructed to allocate 30 trillion soums of working capital through banks so that the manufacturing enterprises do not stop their activities. It was noted that, if necessary, banks should provide loans to enterprises to help pay salaries to the workers.

The videoconference also identified tasks on enhancing remote services, adding new types and expanding their coverage.

During the videoconference, officials and heads of commercial banks provided information relevant to the topic.

Related News

11:09 / 16.02.2026

President Mirziyoyev expected to attend inaugural Peace Council meeting in Washington

13:27 / 14.02.2026

President Mirziyoyev orders 10–20 percent cost cuts at strategic state enterprises

19:58 / 05.02.2026

Tashkent and Islamabad discuss defense and security cooperation

08:46 / 05.02.2026