Ministry of Finance threatens gas refilling stations with measures for price increases

From January 1, 2019 in Uzbekistan, instead of a tax on the consumption of petrol, diesel fuel and gas, an excise tax will be imposed. It is paid while selling to the final consumer of petrol, diesel fuel and gas in compliance with the law of December 24.

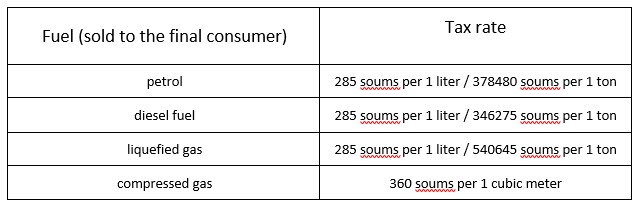

The presidential decree of December 26 defines the following excise tax rates:

While selling petrol, diesel fuel and liquefied gas through gas stations, the excise tax is calculated at the rate of 1 liter, in other cases - per 1 ton.

The excise tax is higher than the current tax for 55 soums, but the Finance Ministry believes that there are no grounds for a sharp rise in prices for liquefied and compressed gas at gas stations.

The ministry reiterated that it would take action against gas stations if facts of unreasonable price increases were detected. The same warning was also addressed in November.

Related News

19:19 / 27.02.2026

Boysun gas field accident will be resolved – President Mirziyoyev

14:59 / 26.02.2026

Competition Committee penalizes gas supplier for unauthorized tariff increases at Angren TPP

14:29 / 25.02.2026

Uzbekistan launches geological exploration at three oil and gas blocks in Afghanistan

12:37 / 25.02.2026