MPs criticize the current state of the capital market

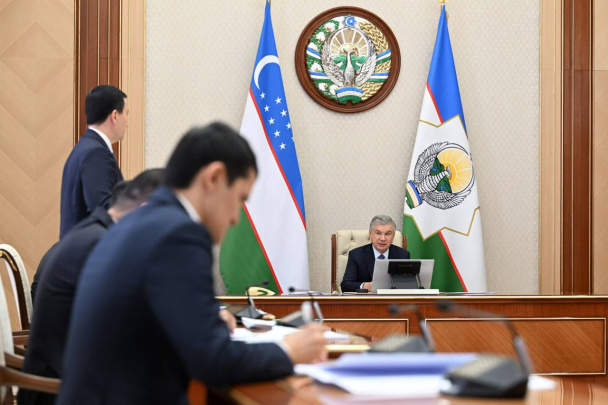

The issuance of bonds by state-owned enterprises of Uzbekistan abroad negatively affects the development of the local capital market, deputies said at a plenary session of the Legislative Chamber of Oliy Majlis on Thursday, January 14.

“As noted by the people’s representatives, the issue of bonds by state-owned enterprises with the participation of foreign representatives, mainly abroad, negatively affects the development of the local capital market and the activities of its participants. The absence of a liquid secondary market for government bonds limits the ability of individuals and non-residents to buy bonds,” the press service of the Lower Chamber said.

According to the deputies, the current state of the capital market in the country remains weak compared to the banking sphere and the insurance market.

At present, the capitalization of the stock market in Uzbekistan is 1% of GDP. This figure is 22% in Kazakhstan, 35% in Russia, 46% in China, 87% in South Korea, 112% in Malaysia and 149% in the United States.

“Research on finding a systemic solution to this problem has not been carried out at the level of modern requirements. Although the concept of establishing integrated relations with international organizations in the securities market is defined in the roadmaps of strategic directions for the capital market development, this strategy has not yet been adopted,” the statement reads.

Based on the above, the meeting decided to send a parliamentary inquiry to the Deputy Prime Minister of Uzbekistan Jamshid Kuchkarov.

Related News

14:15 / 25.02.2026

Uzbekistan’s public debt rises 16.5% year on year to $46.8bn

12:50 / 21.02.2026

President Mirziyoyev backs extension of tax relief to accelerate Karakalpakstan’s industrial growth

20:24 / 20.02.2026

Central Bank survey shows downward trend in public inflation expectations

20:44 / 17.02.2026