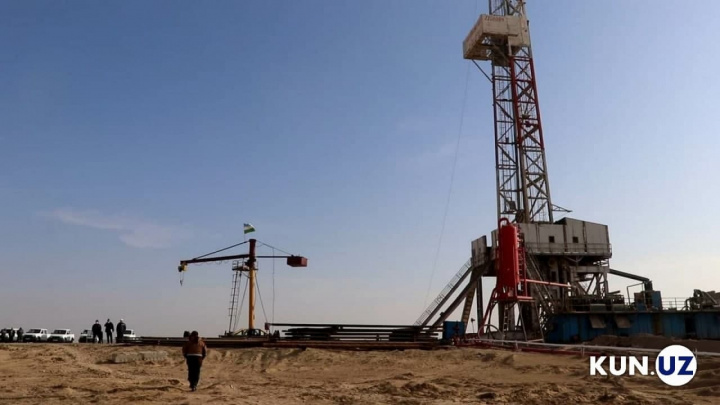

Uzbekneftegaz places debut Eurobonds for $700 million

Фото: forex

Uzbekneftegaz has placed its debut Eurobonds for $700 million on the London Stock Exchange at a rate of 4.75% per annum. The maturity period is set at seven years.

The organizers of the issue were Bank GPB, Citi, J.P. Morgan and MUFG, legal consultant was White & Case LLP.

It is noted that the bonds were purchased by more than 120 investors from the UK, USA, Germany and Asian countries.

It should be reminded that in September, Uzbekneftegaz received its first credit rating from Fitch. The rating is identical to that of the government bonds of Uzbekistan – “BB-” with a “stable” outlook. S&P Global Ratings gave a similar assessment.

In addition to Uzbekneftegaz, UzAuto Motors issued Eurobonds in 2021.

Related News

19:49 / 12.02.2026

Uzbekneftegaz to end sponsorship of three football clubs

17:53 / 29.01.2026

BlackRock subsidiary explores investment in Uzbekistan’s oil and gas sector

14:03 / 29.01.2026

Revised data reveal $700M gap in Uzbekistan’s 2024 gas production figures

15:44 / 28.01.2026