Russia’s Sovcombank purchases Uzagroexportbank for $4 million

There were 4 applicants in total. The Russian bank was chosen because it can bring not only investments, but also experience.

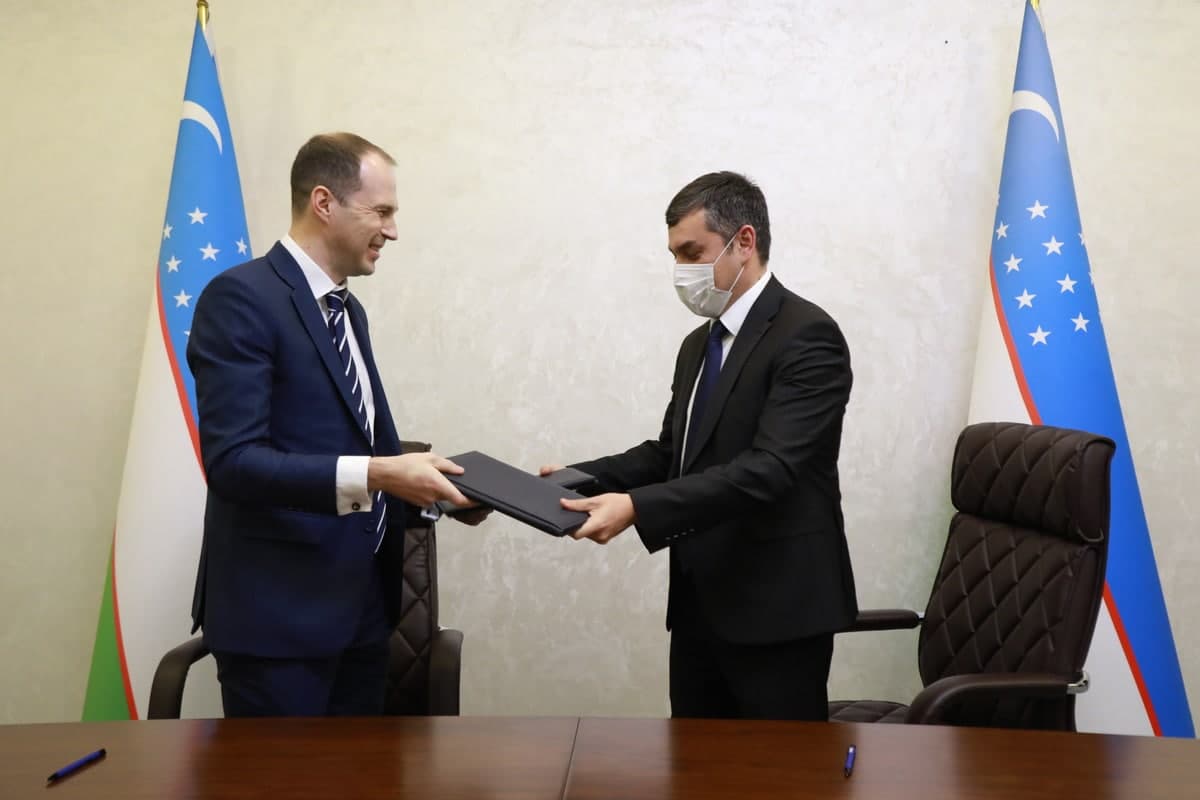

Фото: Uzagroexportbank

The Russian Sovcombank bought out 100% of the state-owned stake in Uzagroexportbank for $4 million, Spot reports referring to the press service of the State Assets Management Agency.

The deal was concluded based on the results of an analysis of the activities of Uzagroexportbank (due diligence), on a competitive basis through a public tender. Grant Thornton, an international company, was engaged as a privatization consultant and KPMG performed the assessment.

In total, 4 bidders expressed interest in buying. Everyone was given access to all information related to the bank, contacts of the consultant, bank management and opened the doors to visit the bank.

Preference was given to Sovcombank as a candidate directly involved in banking activities, capable of bringing not only foreign investment into the country, but also the experience of a foreign bank, modern financial products and services.

Uzagroexportbank was established in 2017 and is 100% owned by the Tashkent city khokimiyat. Among the main tasks of the bank is financial support for exporting organizations, ensuring the effective and sustainable development of the export potential of fruits and vegetables.

The intention to sell the state block of shares in its entirety became known last May. The first stage of the qualifying selection of applicants for the purchase ended in July. In November, there were reports of Sovcombank’s plans to conclude a deal to buy 100% of the shares of Uzagroexportbank, owned by the state.

Uzagroexportbank ended the 3rd quarter of 2021 with a loss of 16.7 billion soums.

For information, Sovcombank is a Russian private universal commercial bank headquartered in Kostroma. The bank’s staff consists of 23 thousand employees in more than 2.3 thousand offices in the Russian Federation. The bank’s customers are 12 million people. Credit ratings on the international scale: S&P – BB, forecast “positive”, Moody’s – Ba1, forecast “stable”, Fitch – BB+.

Related News

11:41 / 13.02.2026

Uzbekistan to dissolve UzTest and privatize certification services

17:21 / 20.01.2026

National Bank sells Zomin cable car to private investor

16:09 / 02.01.2026

Uzbekistan plans to privatize five state-owned banks by 2030

15:55 / 31.12.2025