What should you do if someone scratches your car in a car park?

You parked your car at a shopping centre, mosque, pharmacy or other convenient location. Everything was done by the book — you weren't in anyone's way. But when you returned, you discovered that your car had been damaged. No cameras, no culprit — just a dent and confusion.

Фото: iStock

This happened to me, Mukhamedov Bakhtinur. The car was damaged, but I was able to get full compensation. To help you know how to act in a similar situation, I will tell you step by step what to do.

What to do if you notice damage

As soon as you notice damage, call 102. Do not touch the car or move any objects around until the officers arrive. This is prohibited by the rules and may interfere with the investigation. Turn on your hazard lights and wait for the police to arrive.

You cannot leave before the accident has been recorded.

This is considered fleeing the scene of an accident and carries a fine of 30 BRV — approximately 11.25 million soums in 2025. Even if the scratch seems insignificant, do not leave — otherwise you will be found guilty.

While waiting for the police

1. Look around.

See if the person responsible or any witnesses are nearby. If there is a car with collision marks nearby, write down its number. Talk to security guards or passers-by: someone may have seen the accident or know where the cameras are located.

2. Record everything.

Take photos and videos: a general view of the car park, the position of the car, and close-ups of all damage. If there are debris, paint, or traces of another car on the asphalt, photograph them as well. If you have a dashcam, save the recording.

3. Collect information.

Write down the names and phone numbers of witnesses, including passengers. Check whether your insurance policy is valid and what type of insurance you have — compulsory motor third-party liability insurance or comprehensive insurance.

After the police arrive

The officers will draw up an accident report, a diagram of the accident and a statement of damages.

Carefully check that all damages and circumstances are listed in the documents. Do not sign the report if you disagree with the wording — first clarify with the inspector.

If the person responsible has fled the scene, report this. The police may issue an ‘Interception’ plan and attempt to locate the vehicle based on its description, camera recordings, or witness statements. The report must indicate that the person responsible has not been identified — this is important for receiving insurance payments.

Contact your insurance company.

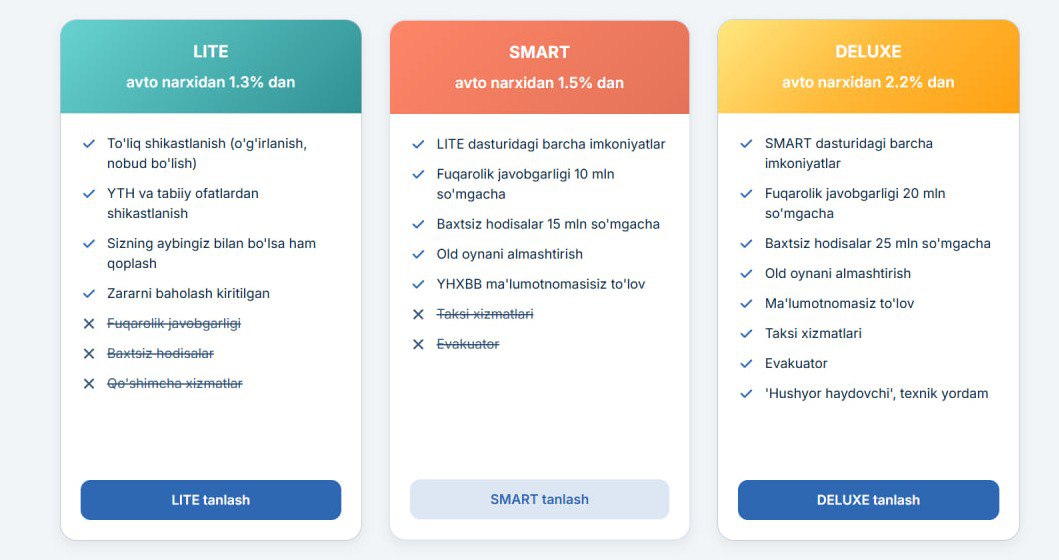

Next, it all depends on the type of insurance. There are two main types in Uzbekistan:

1. Voluntary motor insurance (CASCO)

If you have CASCO insurance, repairs or compensation for damage to your car will not be a problem. The policy covers not only traffic accidents, but also theft, fire, natural disasters, vandalism and other risks. Sometimes the terms of the contract even allow you to request a replacement car — it all depends on the programme and the size of the insurance premium.

CASCO is voluntary insurance that protects your car, regardless of who is at fault in the accident. Unlike MTPL, CASCO compensates for damage to your car even if the perpetrator is not found.

What to do if your car is damaged

1. Call your insurance company. Usually, you need to call to report the accident. The support service number is listed in the policy.

2. Follow the instructions. The insurer may send an accident commissioner or consultant to complete the paperwork.

3. Obtain a certificate. In most cases, you will need a certificate from the traffic police or the Ministry of Internal Affairs about the accident or act of vandalism.

4. Prepare the documents. You will usually need a copy of the report or decision, your driving licence, vehicle registration document and the comprehensive insurance policy itself.

5. Wait for the inspection. The insurance company will send the car to a service station or pay for the repairs.

If you have both CASCO and OSAGO insurance, the insurance company will first receive payment under the OSAGO insurance of the person responsible for the accident, and the remaining amount will be covered by CASCO. For example, if the damage amounts to 20 million soums, 14 million will be compensated under OSAGO, and the remaining 6 million will be paid by CASCO.

How much does CASCO cost?

The cost of CASCO depends on the market price of the car, the selected risks and additional services. Usually, the premium is between 1 and 3% of the car's value. The price increases if you add options such as a tow truck, technical assistance, taxi or tyre replacement.

2. Compulsory motor insurance (CMI)

Like most drivers, I only had compulsory insurance — and, unfortunately, it had already expired.

The full name is ‘Compulsory Civil Liability Insurance for Vehicle Owners’.

OSAGO covers damage you cause to others — people, vehicles or property.

Simply put, this insurance protects not your car, but those who have suffered because of you.

When OSAGO will help

Even if the person responsible is unknown, you can still receive compensation. The main thing is to report the accident correctly and notify your insurance company. Even if you do not have comprehensive insurance and you have suffered damage, report the accident to your MTPL insurer as soon as possible.

This is important for two reasons:

— it is required by insurance rules;

— the insurance company will advise you on how to proceed.

Direct settlement

By law, the driver is obliged to notify the insurer about the accident, even if he is not at fault. If both parties are insured, a direct settlement mechanism applies: you receive payment from your insurer, and they deal with the other party's insurer.

How long does it take to receive payment?

After you submit your claim, the insurance company will begin processing it, which involves collecting documents, assessing the damage, and making a decision. The law gives the insurance company 15 calendar days to review the claim and another 5 business days to make the payment.

If the documents are in order and the case is clear, compensation can be received in less than a month.

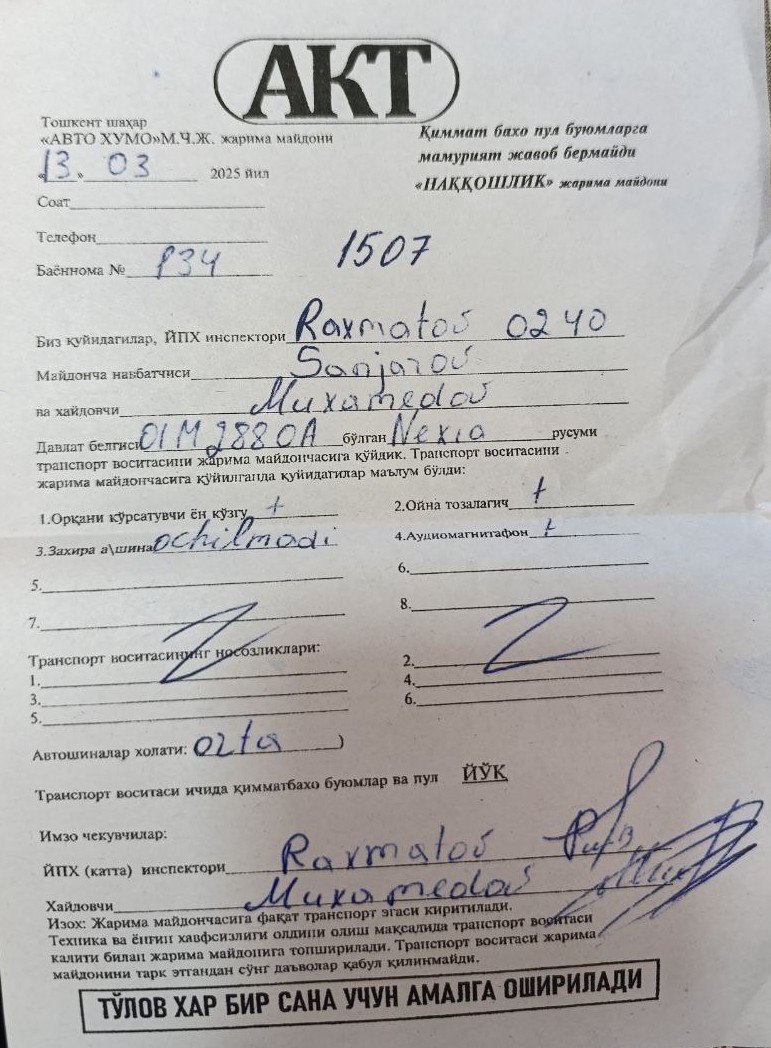

How everything is processed at the Traffic Police

After you file a claim, a traffic police officer inspects the car, draws up a report, and the car is temporarily impounded.

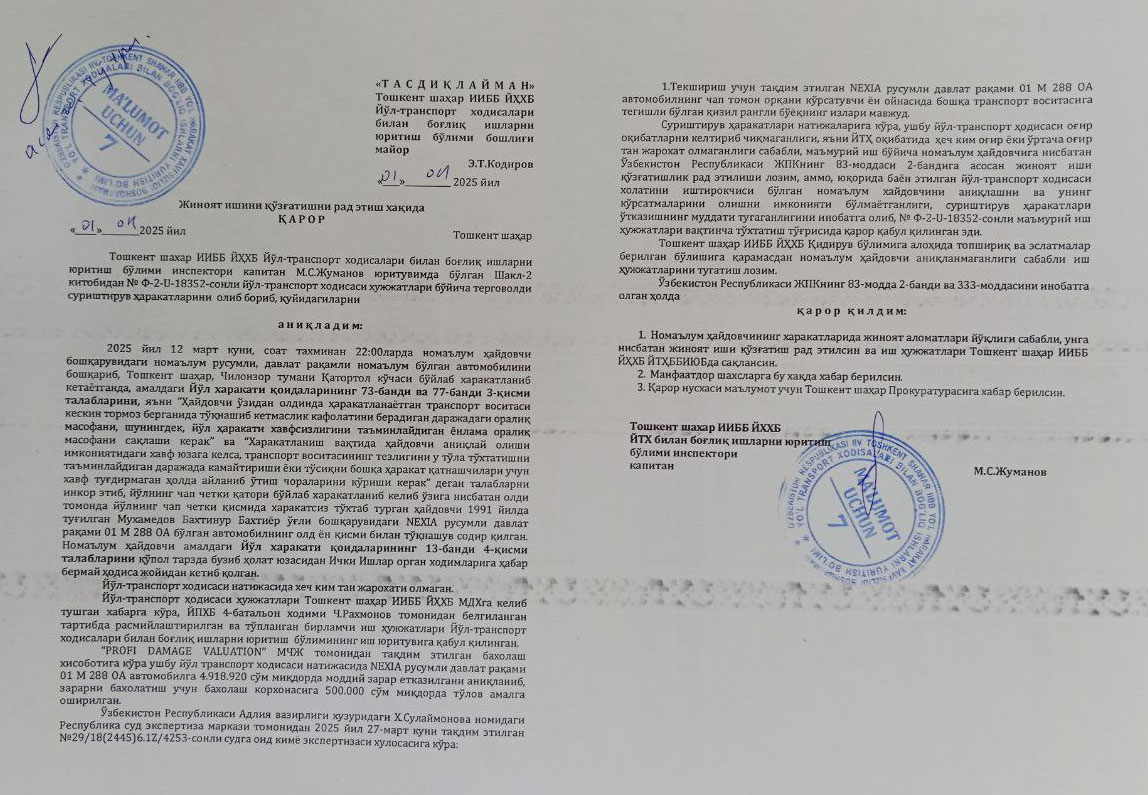

The case is then transferred to the investigation department of the Traffic Police. This department:

● initiates a criminal case if the perpetrator is unknown;

● requests a report from the appraisal company;

● sends the vehicle for examination to the H. Sulaymonova Republican Centre for Forensic Examination under the Ministry of Justice.

If the perpetrator is found, they are obliged to:

● compensate for the damage in full;

● pay court costs;

● receive an additional fine for attempting to flee the scene of the accident.

Leaving the scene of an accident is a serious offence, and when the person responsible is found, they will face a fine and, depending on the damage, possibly a driving ban.

If the person responsible cannot be identified, the case is transferred to the Guarantee Fund for Compulsory Motor Vehicle Liability Insurance.

Independent damage assessment: why it is needed and how to conduct it

To avoid losing out on compensation, order an independent assessment of the repair costs. The insurance company of the person responsible will appoint an expert, but you have the right to invite your own assessor. If you believe that the damage has been underestimated, submit your assessment to the insurer or the court. The cost of such an assessment is usually included in the insurance payment.

Record all expenses related to the damage: tow truck, car storage, expert assessment. These expenses can be included in your claim for compensation. If the case goes to court, receipts and expert reports will serve as evidence of the amount of damage.

Compensation fund: if the perpetrator is not found

The fund will review your application within one month. If the decision is positive, you will be compensated for:

● the amount of damage specified in the assessment report;

● the cost of the assessment company's services;

● mandatory car parking fees.

Compensation is paid even if the policy has expired or the car has not yet been insured (in accordance with Article 26, paragraph 2 of Law No. O'RQ-155).

Even if the person responsible fled the scene, you can still receive compensation through the Compulsory Insurance Payments Guarantee Fund. It was created specifically for such cases: when a driver has been injured but there is no one to receive money from directly.

The fund is financed by insurance companies — part of each insurance premium goes to the fund to compensate victims for damages.

How much can you get

The amount of compensation is limited by law — no more than 40 million soums:

● up to 14 million soums — for damaged property (e.g., a car);

● up to 26 million soums — for damage to health.

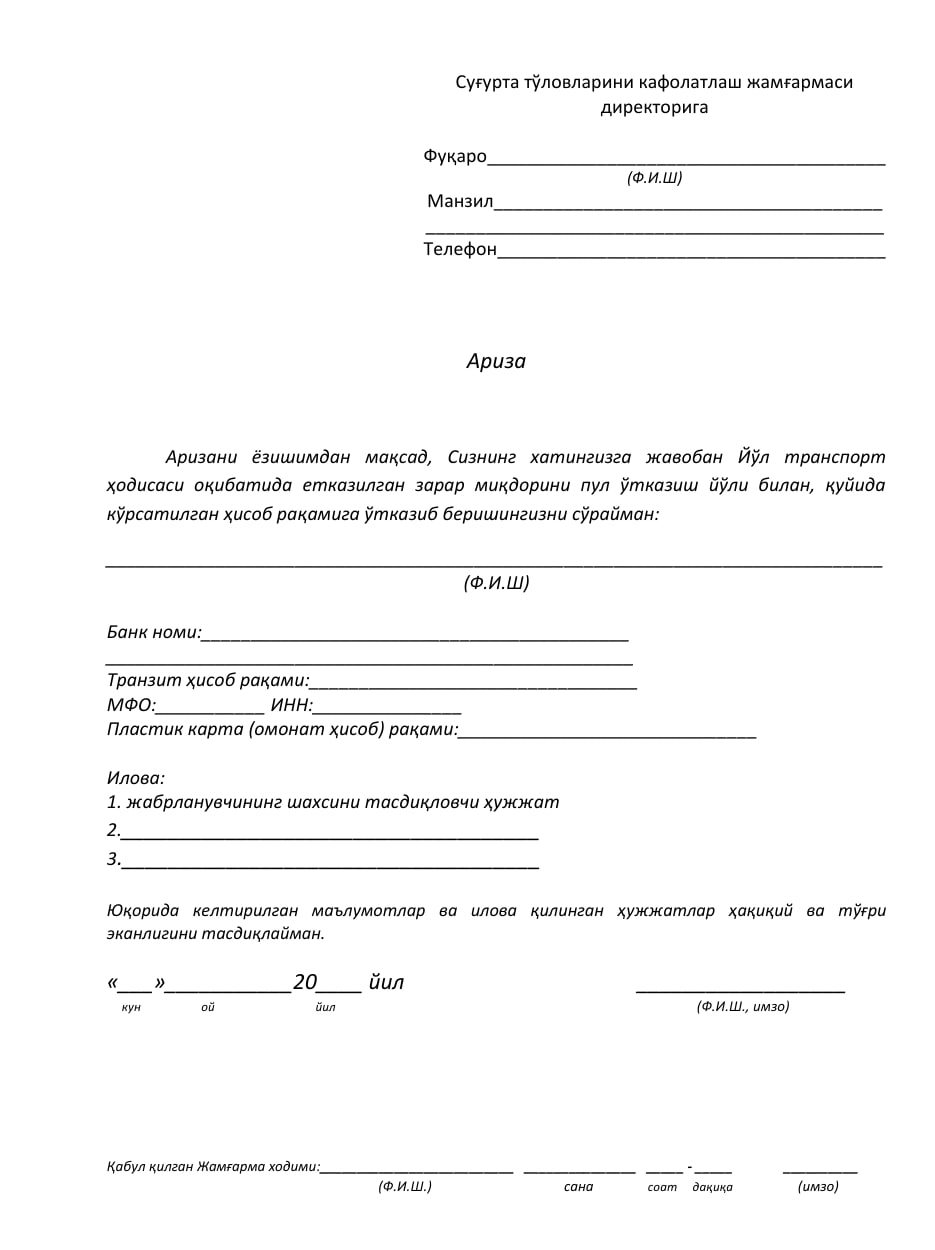

How to receive payment

1. Gather the documents.

You will need materials about the accident, an inspection report, an assessment of the damage and a certificate from the police.

2. Submit an application to the Fund.

In some cases, a court decision will be required if the amount of damage is disputed or the person responsible has been identified but is not compensating for the damage.

3. Wait for a response.

After checking the documents, the Fund will transfer the money within a month.

Then, if the person responsible is found, they will be obliged to return the amount paid to the Fund.

If you do not have a valid motor vehicle insurance policy

Let's consider a specific case: your car is damaged, but your motor vehicle insurance policy has expired or has not been issued. This will not prevent you from receiving compensation, as either the at-fault party's insurance, your comprehensive insurance, or the Fund will pay, as described above.

However, be prepared for a fine for not having compulsory motor insurance. Driving without compulsory motor insurance in Uzbekistan is an administrative offence. When your documents are checked (and they will definitely be checked at the scene of the accident), you will be fined 375,000 soums.

In addition, if you are ever involved in an accident without insurance, all victims will demand money from you personally. Without insurance, you will be obliged to pay out of your own pocket or through the courts, and the Fund will only pay for you initially and then present you with the bill.

Note: if the car was simply parked and you were not driving it, the absence of compulsory motor third-party liability insurance is still formally considered a violation (the requirement to insure arises 10 days after purchasing the car). The police can even fine you for a car that is parked without insurance.

Conclusion

Even if your car was damaged in a car park and the perpetrator fled the scene, you can obtain full compensation if you have the correct documents.

The main thing is to act in the following order:

1. Do not move the car.

2. Call 102.

3. Notify your insurance company.

4. Fill out all the paperwork correctly and be patient.

Remember:

Insurance is an investment in your peace of mind. A small amount paid on time can save you from big problems in the future.