Uzbekistan eliminates corporate income tax for high-tech manufacturers

Tax incentives are being introduced for the creative industry, as well as textile and footwear enterprises.

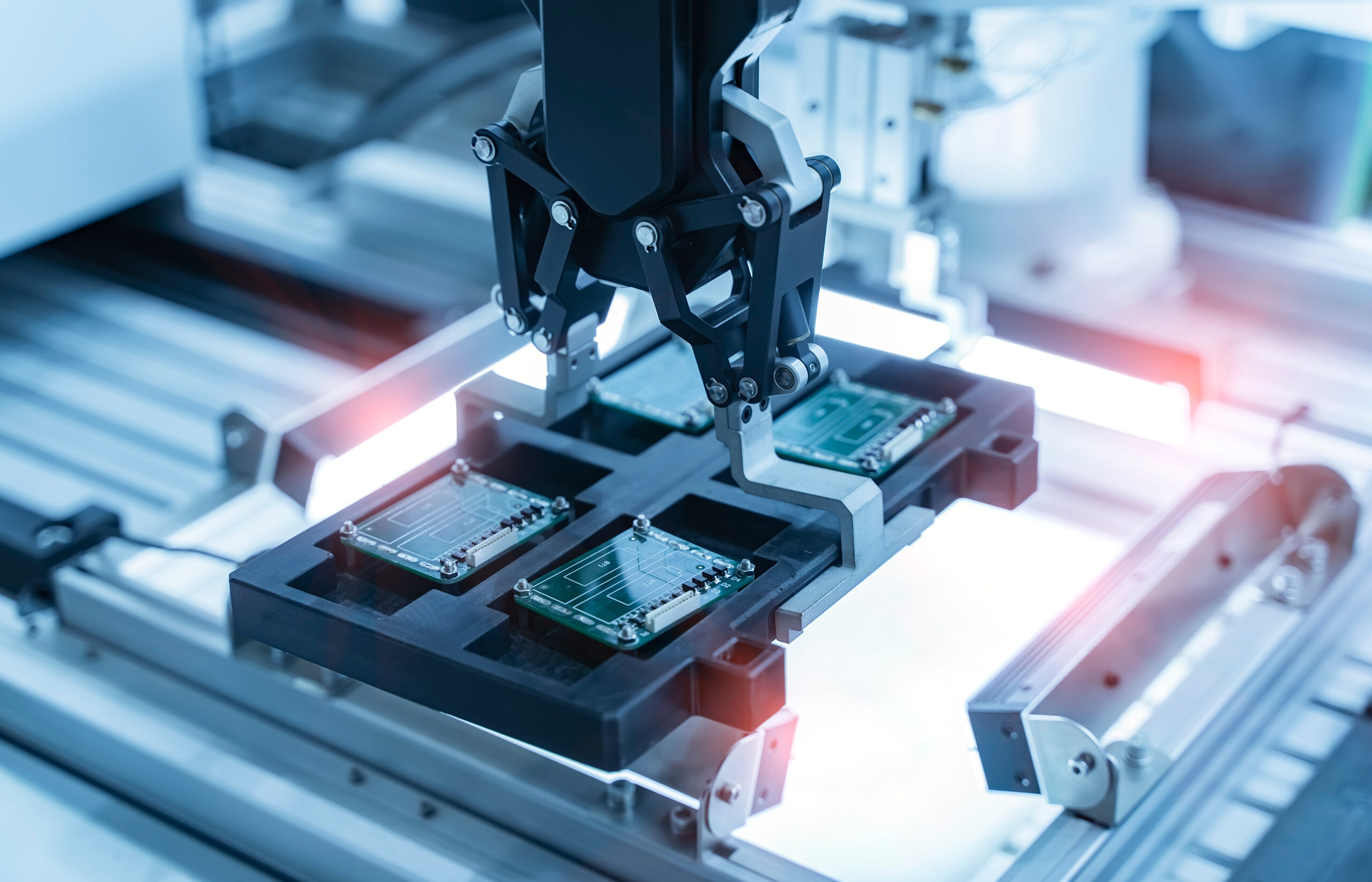

Photo: Getty Imagеs

Uzbekistan is rolling out a range of new tax incentives for high-tech and other sectors of the economy. President Shavkat Mirziyoyev signed the relevant law on December 25, 2025.

The corporate income tax rate on profits earned from the sale of products manufactured using high technologies is set at zero. In addition, the average annual residual value of equipment used to produce such goods will be deducted from the property tax base.

The list of high-tech product manufacturers eligible for these incentives will be approved by the president. The benefits will apply for three years after a production facility is commissioned.

A zero turnover tax rate is also being introduced for freight forwarding services provided in international transportation. The eligible services include:

– acceptance, delivery, and storage of cargo;

– organization of cargo insurance;

– customs clearance of goods and vehicles;

– tracing cargo not delivered on time;

– storage of cargo at freight forwarders’ warehouses.

In addition, tax incentives are being introduced for certain sectors of the economy. In particular, until January 1, 2028, garment and knitwear manufacturers, footwear producers, and leather enterprises will be subject to a corporate income tax rate of 2% and a social tax rate of 1%.

To qualify for these benefits, a company must earn at least 70% of its revenue from core activities and from processing raw materials under contracts. The minimum salary for employees must be set at two times the minimum wage, or UZS 2.542 million.

Legal entities that are residents of the Creative Park will pay personal income tax and social tax at rates two times lower than the standard rates until the beginning of 2031. At the same time, they will be required to pay turnover tax regardless of income levels.

Income earned by legal entities from bonds issued by mortgage refinancing organizations and their authorized affiliates will be exempt from corporate income tax until 2030. The exemption applies to all interest income accrued over the entire circulation period of the securities.

The validity period of social tax incentives for employees under the age of 30 in the hotel industry, public catering, retail trade, transportation, auto repair, veterinary services, and agricultural services has been extended until the beginning of 2028. The preferential rate applies if an employee’s salary is at least 2.5 times the minimum wage, or UZS 3,177,500.

The law also exempts land used by state pasture farms from land tax. In addition, the social tax and personal income tax rates for employees of cooperatives engaged in the collection and processing of medicinal herbs are reduced to 1%.

Related News

15:48 / 27.02.2026

Uzbekistan zero rates VAT at Termez trade hub to boost exports

12:04 / 27.02.2026

Uzbekistan to streamline tax administration with unified payment system

17:14 / 24.02.2026

Nearly 12,500 tax violation reports filed in one month – UZS 3 billion paid to reporting citizens

07:33 / 21.02.2026