How to get a 12% refund on university tuition

If you pay university tuition in Uzbekistan, you can receive 12% of the amount back through a tax deduction. The deduction can be claimed through your employer or by submitting a tax declaration to the tax authorities. Below we explain all available methods, eligibility requirements, and common reasons for rejection.

How the education tax deduction works

Income used to pay for education in accredited educational institutions is not subject to personal income tax (PIT).

How this works in practice:

- you earn income and PIT is withheld at a 12% rate;

- you pay your university tuition;

- the tuition amount is excluded from your taxable income;

- the tax is recalculated.

Refund formula: tuition amount × 12%

For example, if tuition is 25 million UZS, you can receive up to 3 million UZS, provided that this amount of PIT was actually withheld from your income.

Who can receive the 12% refund

The deduction applies to tuition paid for:

- your own education;

- your child’s education;

- your spouse’s education.

The university must be an accredited educational institution. The benefit applies to both public and private universities with a valid license.

The deduction does not apply to:

- tuition for siblings, nephews, nieces, or other relatives;

- education paid from income that is not subject to PIT;

- expenses not supported by documents.

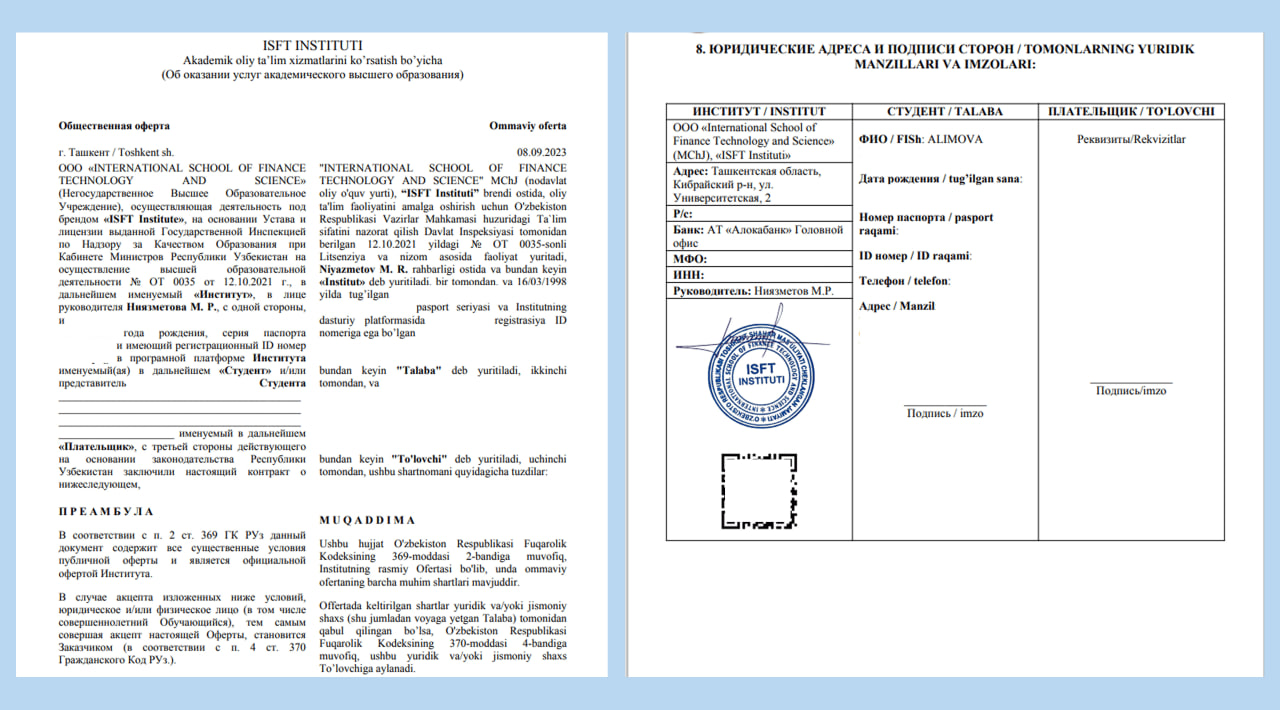

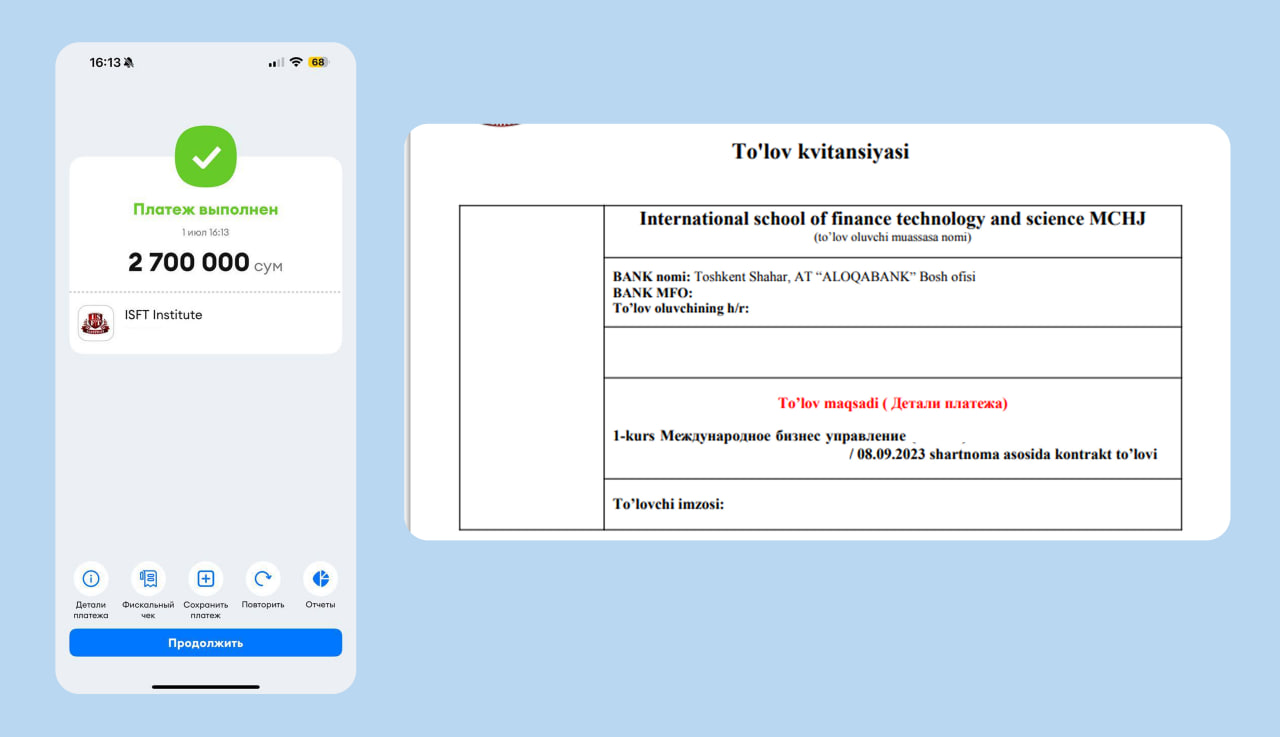

What documents are required

To confirm your right to the deduction, you need:

- the university contract;

- payment documents: receipts, bank transfers, statements;

- an income certificate — if you are applying through a tax declaration;

The main requirement is that all personal data must match. The payer’s name in payment documents must match the name of the person claiming the deduction.

A common mistake:

The contract is issued in the student’s name, but the parent pays from their bank account. If the parent applies for the deduction but is not listed as the payer in the contract, the tax authority may reject the request. Documents must clearly confirm the parent’s right to pay for the education and claim the benefit.

Another common issue is the lack of proof of payment. The contract alone does not provide the right to a refund.

How to apply for the deduction through your employer

This method works if:

- you are officially employed;

- tuition is paid in the current year;

- the accounting department is able to apply the deduction monthly.

In this case, part of your income is simply not taxed — you pay less PIT immediately. The money is not returned via transfer; your monthly tax is reduced.

What to submit to the employer

Provide:

- an application to apply the tax deduction;

- the university contract;

- payment documents confirming tuition payment;

- if applicable — a document confirming family relation (for a child or spouse).

The accounting department will reduce your taxable income by the amount of tuition paid and recalculate PIT.

When this method does not work

You cannot use this method if:

- tuition was fully paid in the previous year;

- you left your job;

- payment was made retroactively;

- the employer has already withheld taxes and closed reporting;

- your income is insufficient to apply the deduction fully.

In these cases, the deduction must be claimed by filing the annual declaration and submitting a refund request.

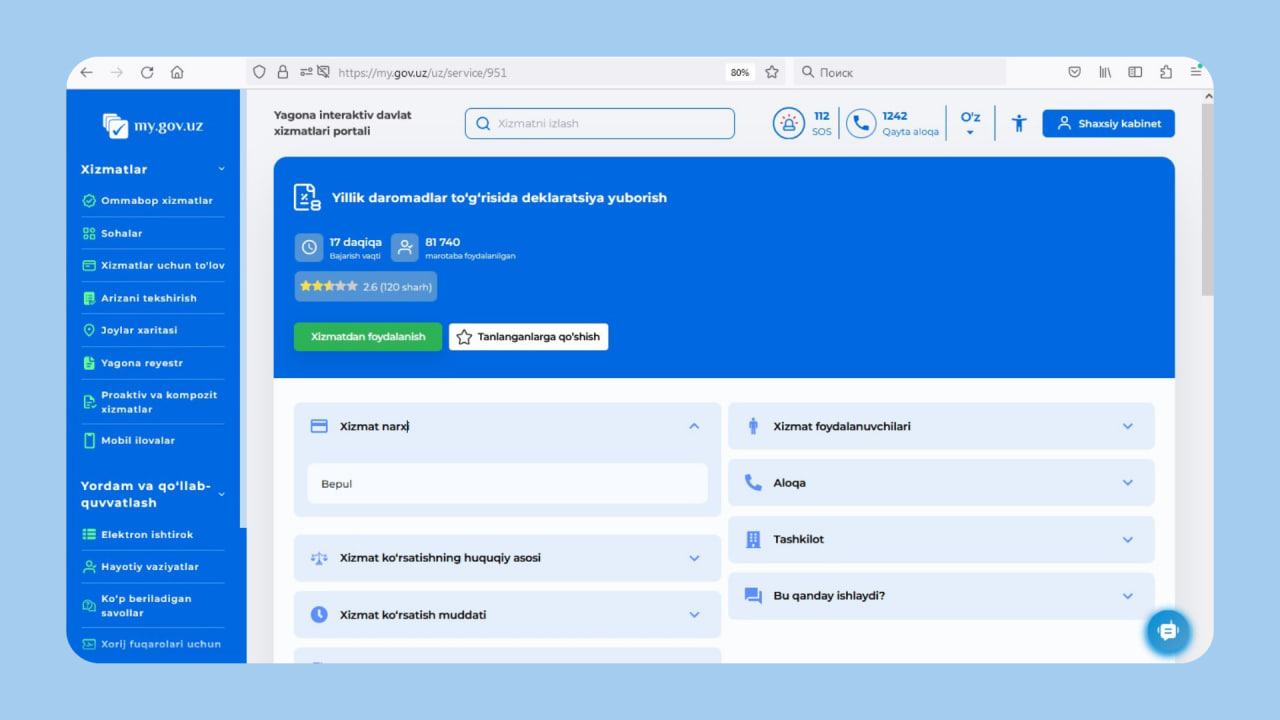

How to get a 12% refund through my.gov.uz

This method is suitable when PIT has already been withheld and you want the refund transferred to your bank account.

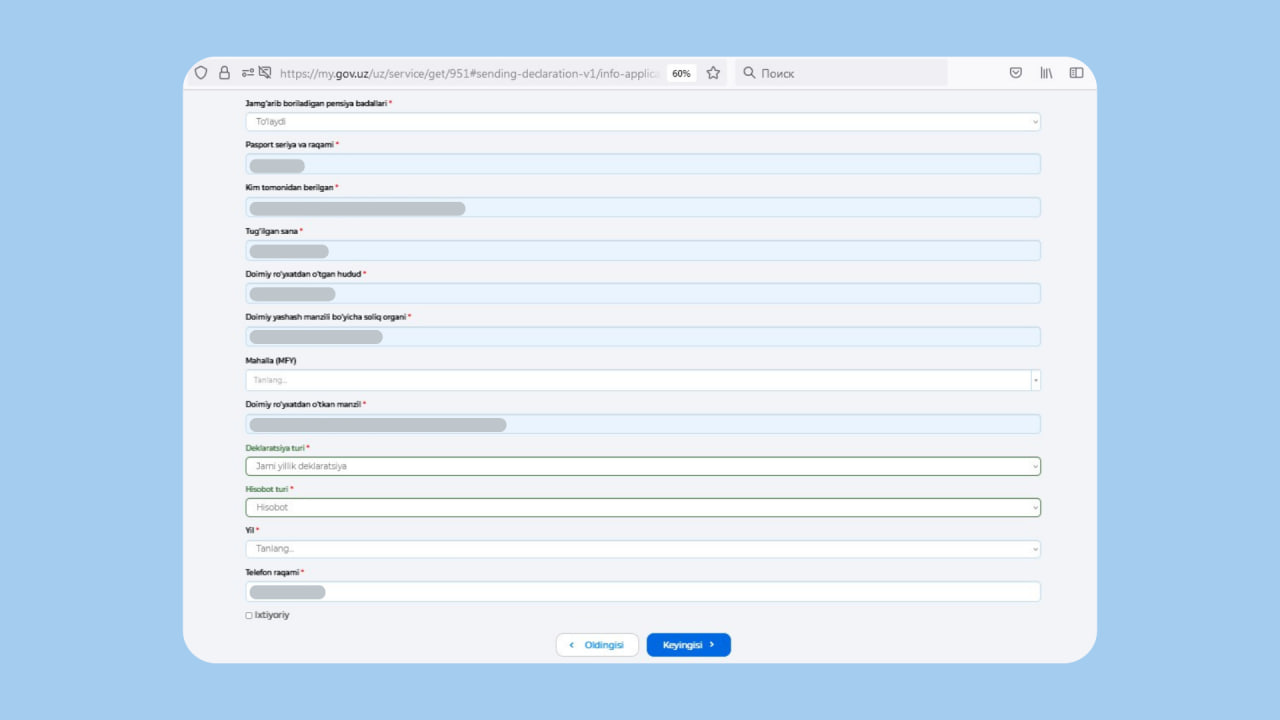

Step 1. Submit the declaration

- Go to my.gov.uz.

- Select “Sending an annual income declaration”.

- In the “Declaration type” field, select:

- Annual income declaration for individuals

- Report type — Calculation

- Specify the reporting year.

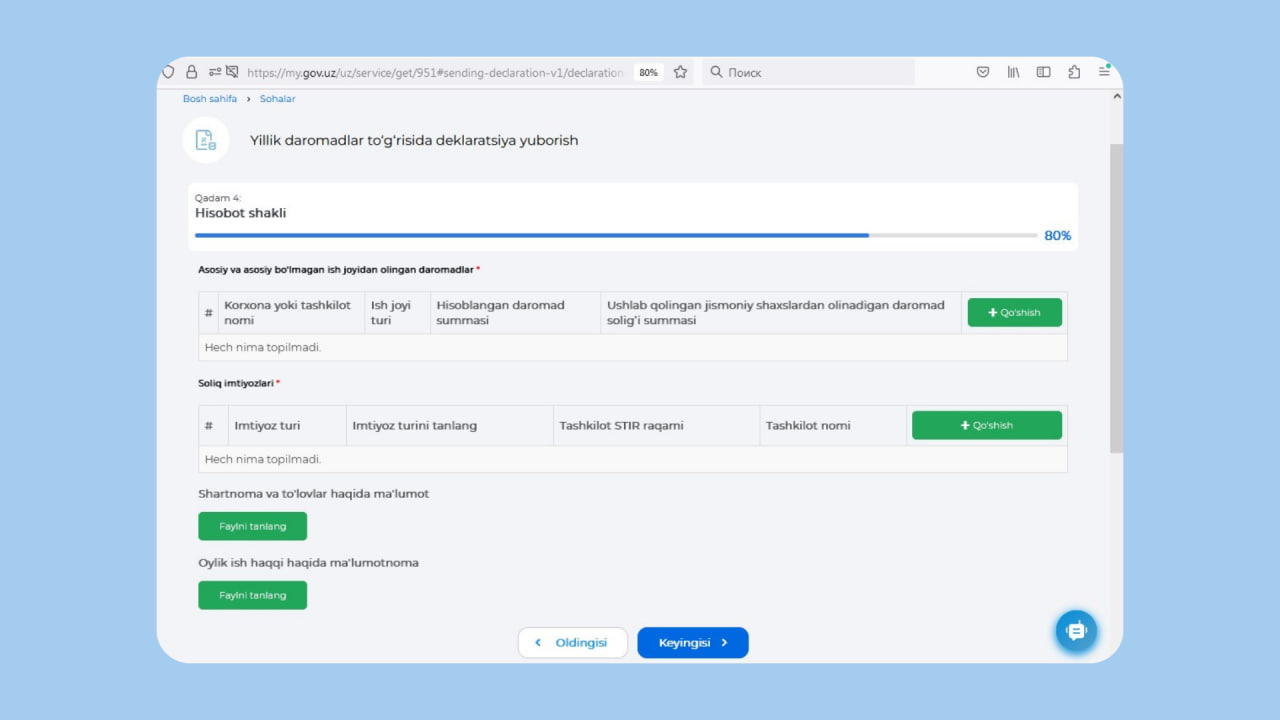

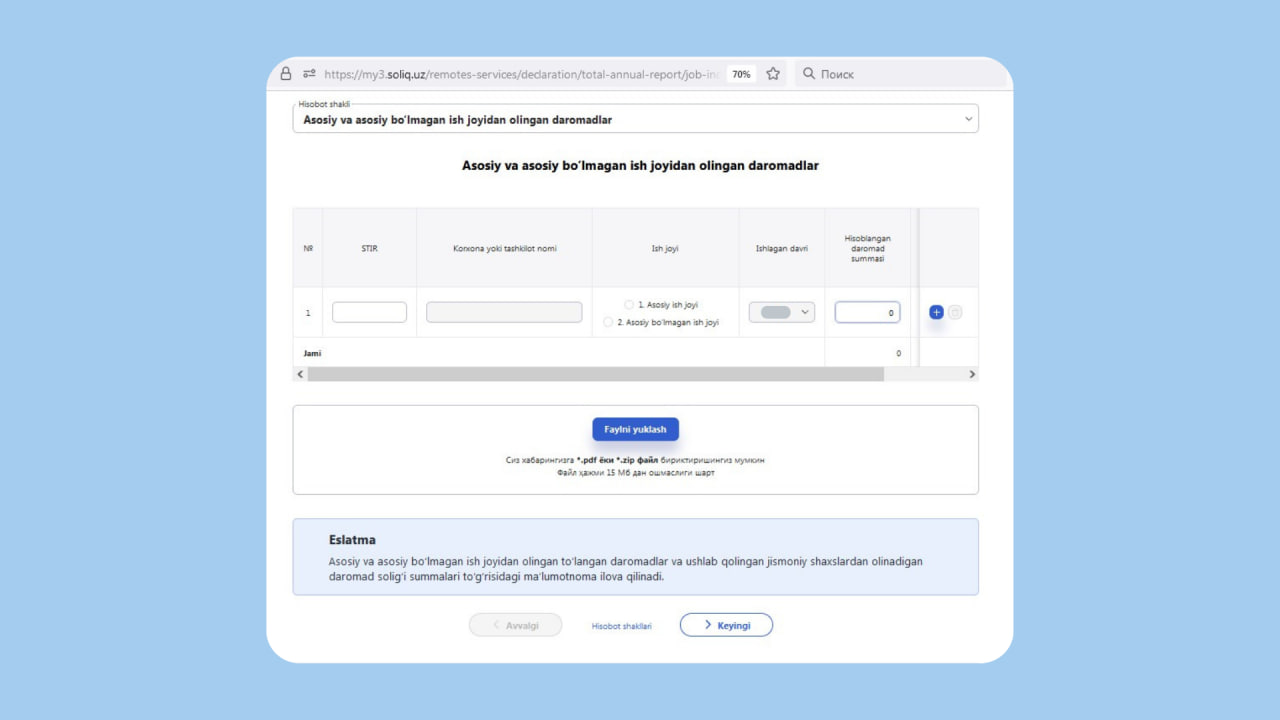

At the “Reporting form” stage:

- add income from your main workplace;

- indicate total income;

- indicate PIT withheld;

- proceed to the “Tax benefits” section.

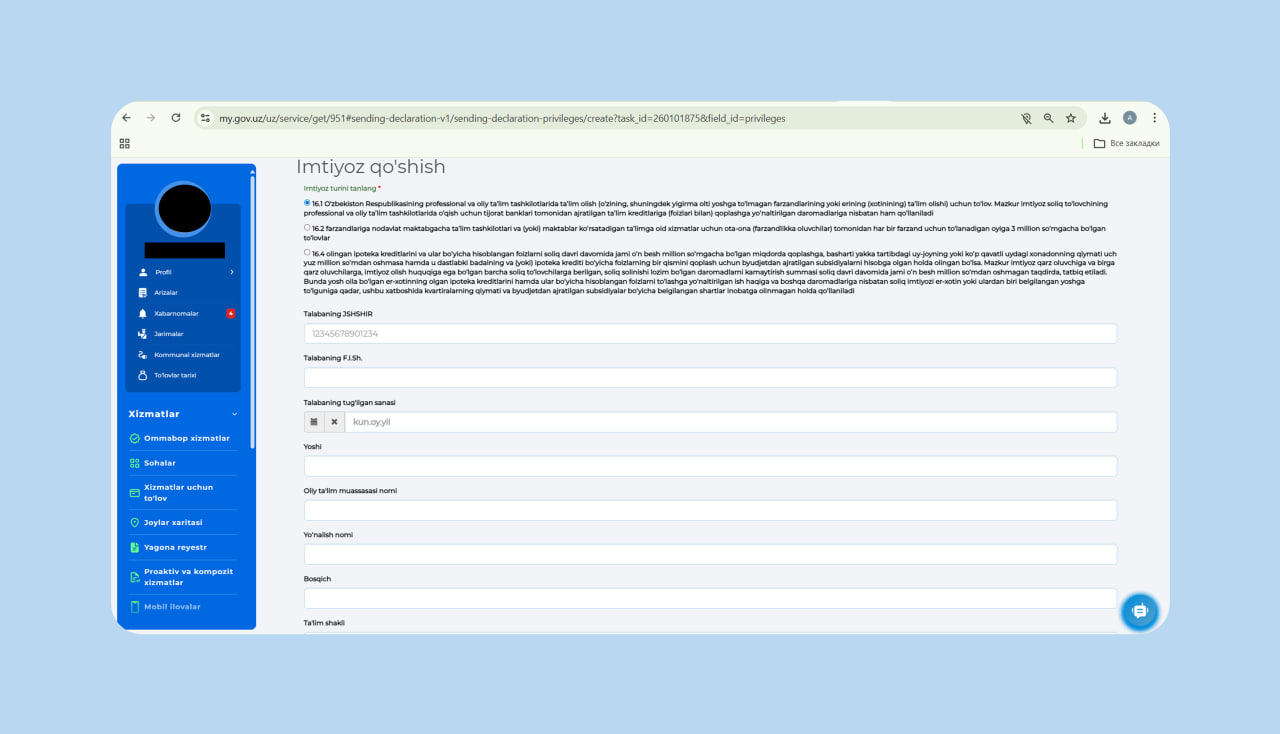

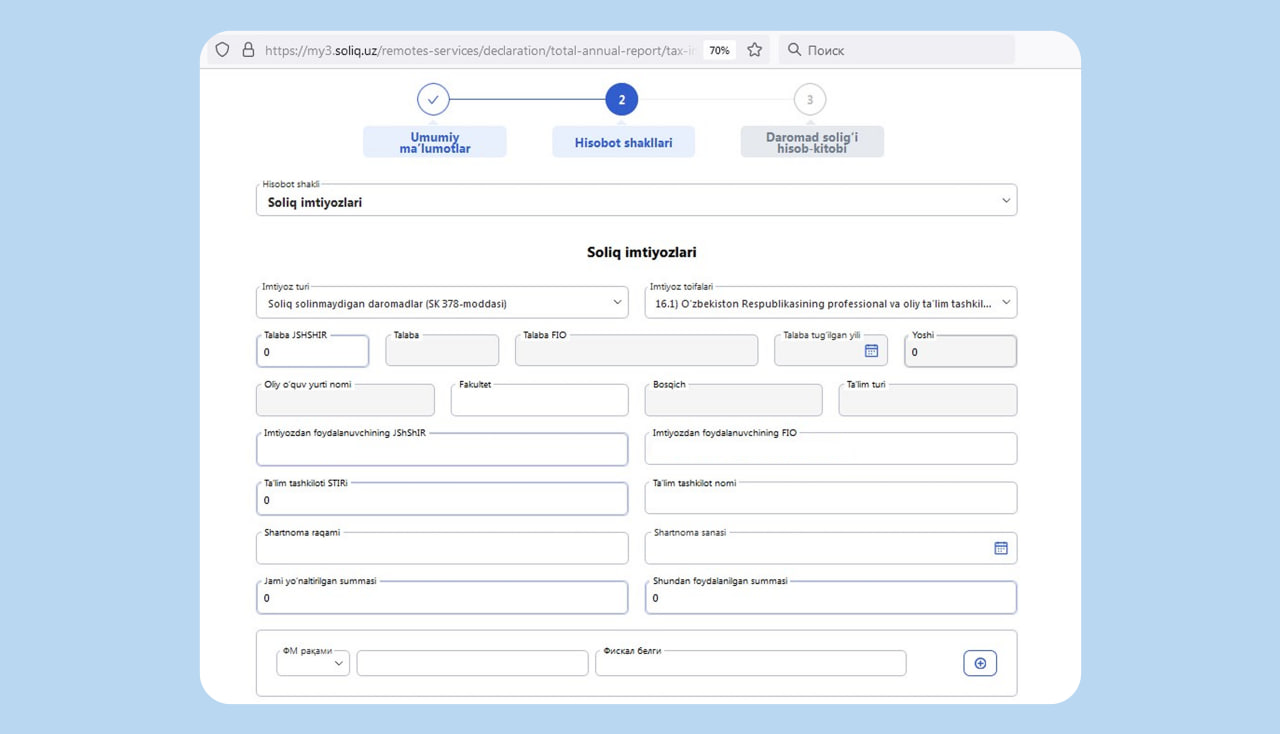

Step 2. Add the deduction

In the “Tax benefits” section:

- select category 16.2, Article 378 of the Tax Code;

- enter the TIN of the educational institution;

- enter the tuition amount paid;

- attach the contract and payment documents.

The system will automatically recalculate the tax.

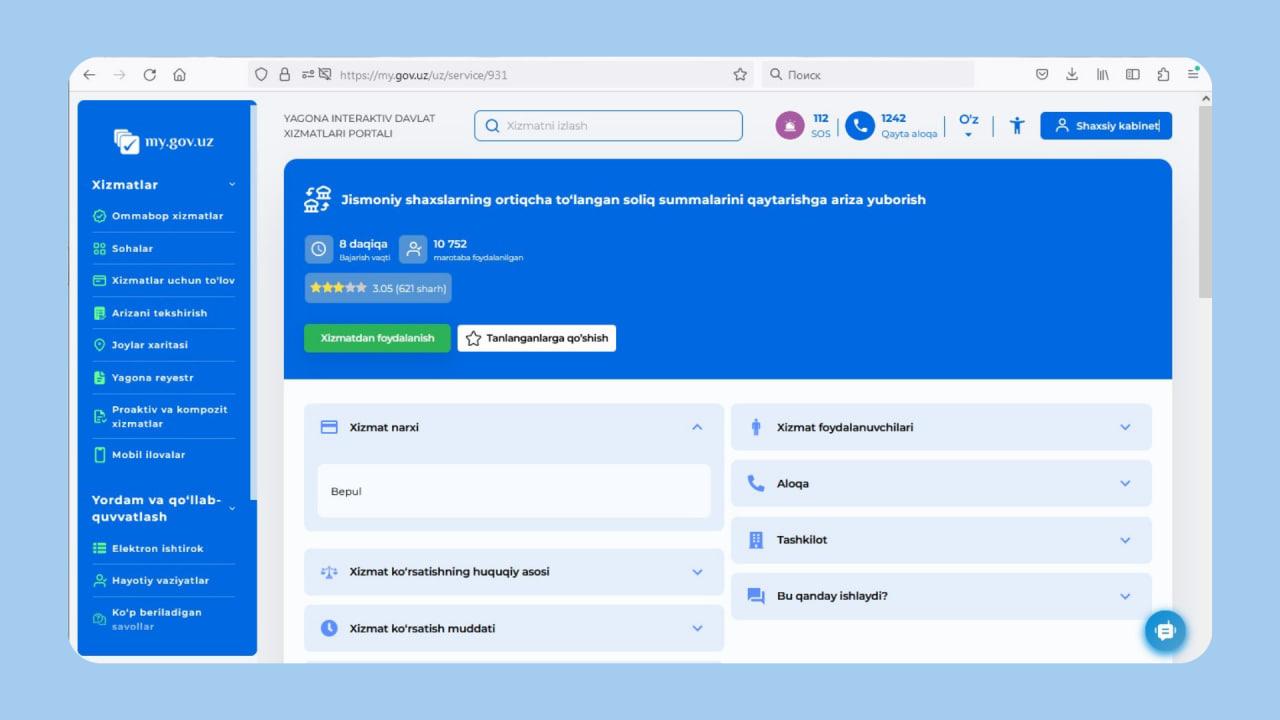

Step 3. Submit the refund request

After the declaration is accepted.

- Enter your card number, MFO, and bank account details.

The refund is transferred within 15 working days after the application is accepted.

How to get a 12% refund through my3.soliq.uz

This method is used if you have an electronic signature.

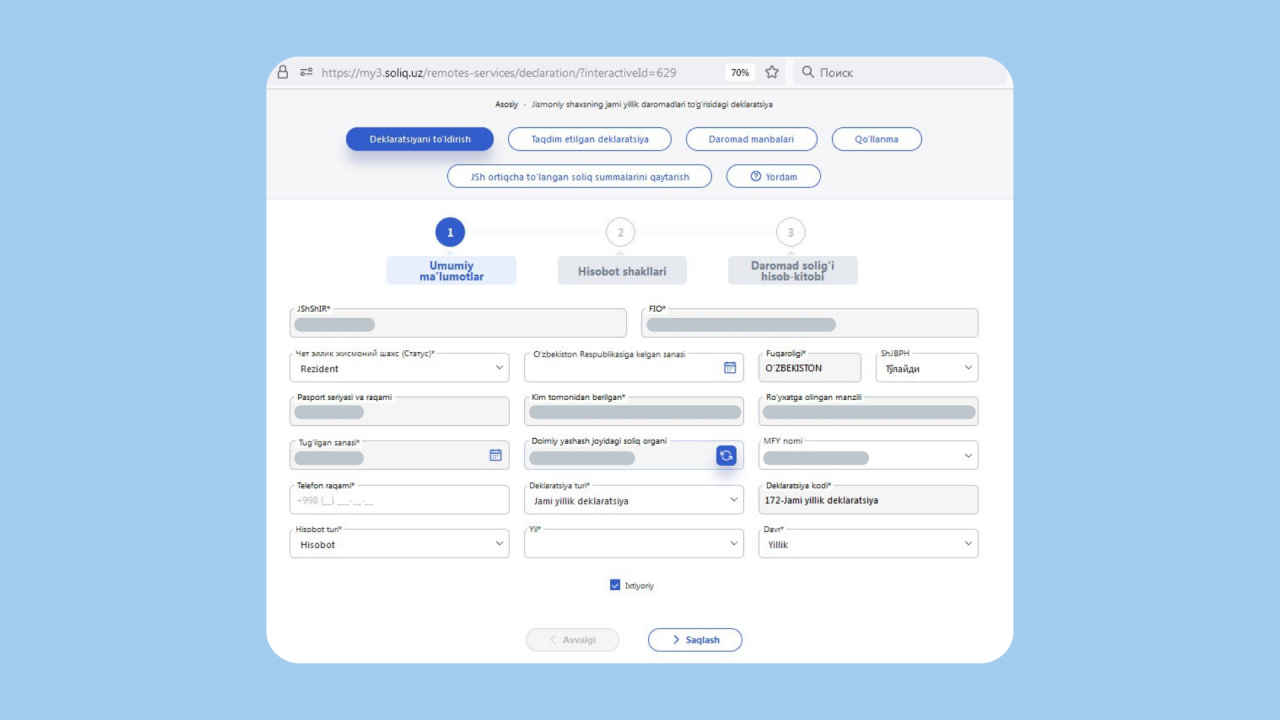

Step 1 — Declaration

In your personal account, select “Annual income declaration for individuals”.

Fill in:

- reporting year;

- income information;

- PIT withheld.

In the tax benefits section, select tuition payment (category 16.2) and attach the contract and receipts.

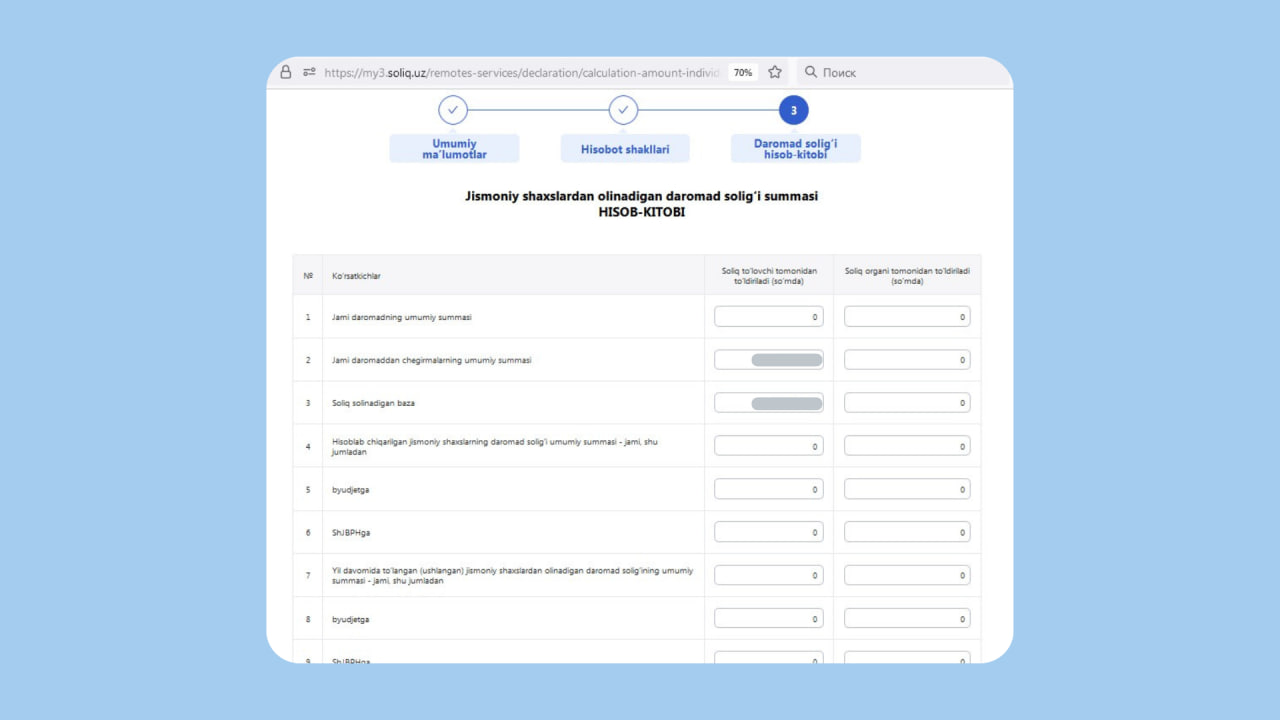

After submission, the system automatically calculates the refund amount.

Step 2 — Refund request

Once the declaration is approved, select the refund service, enter your bank details, and submit the application.

Refund processing time

The refund is transferred after the tax authority reviews both the declaration and the refund request. Processing time depends on the accuracy of the data and system workload.

What to check before submitting the declaration

Before submitting documents to your employer or sending a declaration online, verify four key points.

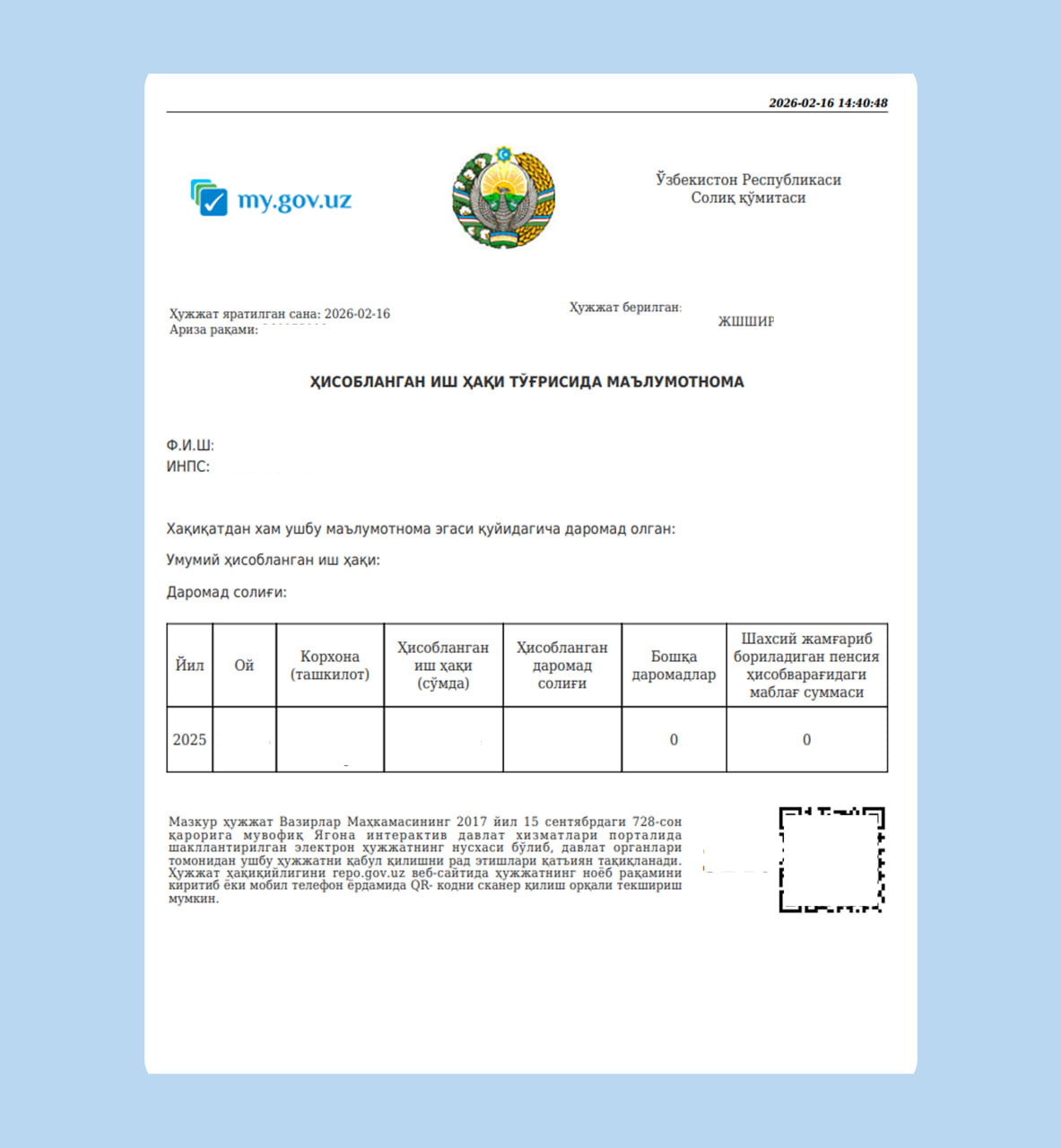

1. PIT was actually withheld

A refund is possible only if PIT was paid. If you were not officially employed or your income was not taxed at 12%, there is nothing to refund.

Check your income certificate or your taxpayer account — the withheld tax is shown there.

2. All documents match

Your name must match:

- in the university contract;

- in payment documents;

- in the declaration.

If one person paid but another claims the deduction, the tax authority may refuse.

3. Tuition was paid within the same tax period

Only the amount paid in the reporting year can be declared.

Example: If part of the 2025 tuition was paid in December 2024, it belongs to the 2024 tax period.

Declaration deadline

The annual income declaration must be submitted by April 1 of the year following the reporting period.

Examples:

- income for 2025 → declaration by April 1, 2026;

- income for 2026 → by April 1, 2027.

Late submission may result in penalties or refusal to recalculate the tax.

What you need to remember

- You can refund 12% of the amount actually paid for university tuition.

- The refund cannot exceed the PIT withheld from your income.

- You must have official income, and the tuition must be paid to an accredited university.

- You can apply through your employer during the same year or through a declaration by April 1 of the following year.

- All documents must confirm payment and match the personal data of the applicant.

Related News

12:32 / 19.02.2026

Construction and manufacturing firms owe trillions in unpaid taxes – Tax Committee

20:11 / 17.02.2026

Tax Committee plans to automate VAT refunds to support business growth

20:05 / 17.02.2026

Uzbekistan to subsidize electric vehicle charging costs from May 1

16:09 / 09.02.2026