Analysis: Is China’s “debt trap diplomacy” dangerous for Central Asia?

Фото: KUN.UZ

China has been extending large amounts of credit to developing and poor countries hungry for infrastructure investment. Western countries accuse official Beijing of trying to dominate low-income countries’ strategic assets and natural resources, following their loans. Can Central Asian countries also fall into China’s “debt trap”?

In August of this year, a meeting between representatives of Egypt and China took place in Switzerland. In it, the Egyptian government discussed the possibility of exchanging the $8 billion loan from China for strategic assets in the country’s ports and airports. Also, the Egyptian delegation offered $10 billion worth of other important assets.

According to a World Bank report released in early July, Egypt’s external debt is about $158 billion. According to the same report, official Cairo has to fulfill its external debt obligation of $33 billion in one year.

When it comes to Chinese loans, various rumors are often mentioned around it. Unlike other international financial institutions, China does not fully disclose information about its loans and their interest rates. The borrower does not impose conditions such as carrying out various democratic reforms and ensuring human rights.

For its part, the Chinese government has denied that the large-scale investment projects have ulterior motives. Western politicians and critics accuse official Beijing of using “debt trap diplomacy” to try to dominate strategic assets and natural resources in developing and poor countries.

Secret lender

While the Paris Club specializes in solving problems between debtor and creditor countries, the London Club manages relations between debtor countries and private companies (or banks) that lend to them. Member states of these clubs freeze certain levels of lending and take consolidation measures (such as debt forgiveness or extension) when the debtor’s public debt becomes excessive.

China is not a member of these clubs, and because of this, when it lends to a certain country, it does not look at and calculate how much it owes to other countries.

Also, China is not part of the Organization for Economic Co-operation and Development (OECD) group that provides data on long-term and short-term commercial credit flows. In this respect, it is not possible to obtain complete information about China's international credit documents.

Worrying signs

According to research by the Center for Global Development in the United States, countries such as Sri Lanka, Kyrgyzstan, Djibouti, Maldives, Laos, Mongolia, Pakistan, Montenegro, Angola and Tajikistan have fallen into China’s “debt trap”. When these debtor countries face financial problems, it is not excluded that their strategic facilities may be withdrawn.

Sri Lanka

China is Sri Lanka’s largest creditor, accounting for nearly 10% of the country’s total external debt. In particular, from 2000 to 2020, the official Beijing provided loans to Sri Lanka of about $12 billion, and most of them were spent on the construction of infrastructure projects. In particular, the Hambanthota Harbour is considered one of such investment projects, and China Merchant Port Holdings Limited was forced to lease 70% of the shares of the port for $1.12 billion for 99 years. Trade in luxury goods and spices is one of the main sources of income for this country located in the Indian Ocean. The Hambanthota Harbour is very important in foreign trade relations.

China’s economic involvement in Sri Lanka has grown significantly over the past decade and is likely to use this to advance its political ambitions in the region.

Kyrgyzstan

China is Kyrgyzstan’s biggest creditor. This is 45% (more than $1.5 billion) of the foreign credit obligations of the neighboring republic. Over the past decade, China has increased its lending to Kyrgyzstan and provided funds for a number of major infrastructure projects.

China has invested nearly $1 billion in energy projects in the country, and it is planned to make Kyrgyzstan a supplier of energy resources to the South Asian region in the future. This has fueled fears that official Bishkek may fall into a “debt trap”.

In March 2021, Kyrgyz President Sadyr Japarov did not rule out the possibility that some important facilities in the country would come under Chinese control if official Bishkek does not pay its foreign debt to the PRC.

The Kyrgyz leader mentioned the largest power plant in the north of the country - the Bishkek thermal power station, the Datka-Kemin power transmission line, as well as the connecting road between the north and south of the republic – as facilities that can come under Chinese control.

After local protests, a joint venture formed by China’s One Lead One (HK) Trading Limited is abandoning a $280 million project to build a logistics center in Kyrgyzstan.

Maldives

In this country, China is participating in three major investment projects:

- modernization of the international airport worth about $830 million;

- the construction of a residential complex and a bridge near the airport worth about $400 million;

- moving the main port.

According to statistics published by the Ministry of Finance, the country’s foreign debt reached $6.39 billion by the end of the first quarter of 2022. This accounts for 113% of GDP. It is noted that more than 50% of the external debt of the Maldives is accounted for by China.

In this country, the official Beijing claims an exclusive economic zone of about 859 square kilometers, adjacent to the main shipping route between China, the Middle East and Europe.

Laos

Laos, one of the poorest countries in Southeast Asia, also has a number of “One Belt, One Road” infrastructure projects. The largest of them is the $6.7 billion China-Laos railway, the value of which is almost half of the country’s gross domestic product. The IMF also warned that the project could threaten Laos’ ability to pay its debts.

According to AidData Lab, the total value of Laos’ public debt from China is about $12.2 billion, far higher than World Bank estimates.

Experts argue that Beijing’s global expansion and infrastructure-based foreign policy increase the risk of poor countries such as Laos falling into a “debt trap”.

Pakistan

Pakistan is participating in the China-Pakistan Economic Corridor (CPEC), a flagship project of the One Road initiative. The total cost of CPEC is estimated at $62 billion, 80% of which is financed by China. And relatively high interest rate loans offered by China increase Pakistan’s debt risk.

Tajikistan

For several years, Chinese historians have been claiming that some parts of the territory of Tajikistan belong to China. 2011 Tajikistan gives China 1.1 sq km of mountainous Badakhshan region rich in natural resources in return for large loans on preferential terms. It was 0.8% of the country’s territory.

According to the data at the beginning of 2022, the total external debt of Tajikistan is $3.3 billion, of which $1.98 billion was attracted from the Eximbank of China.

Almost all gold in Tajikistan (84%) is mined in Tajik-Chinese joint ventures. According to data, at the same time, more than half of the gold mines in Tajikistan belong to Chinese companies. In particular, the Upper Kumarig gold mine was given to Chinese companies for development.

In addition, Eximbank of China and the government of Mongolia signed an agreement on the financing of the construction of a large highway and hydroelectric power plant, the estimated cost of which is $1 billion.

China will also finance 85% of the construction of the highway connecting the Montenegrin city of Bar with Serbia. The estimated cost of the project is $1.1 billion.

Djibouti is another country that owes a lot of money to China. Following the $3.5 billion Djibouti International Free Trade Zone project and several other projects, the country's external debt has increased from 50% to 85% of GDP. After that, it will have to rent one of its military bases to China for only $20 million a year.

Can the countries of Central Asia fall into a debt trap?

China continues close trade and economic relations with Central Asian countries, including preferential loans.

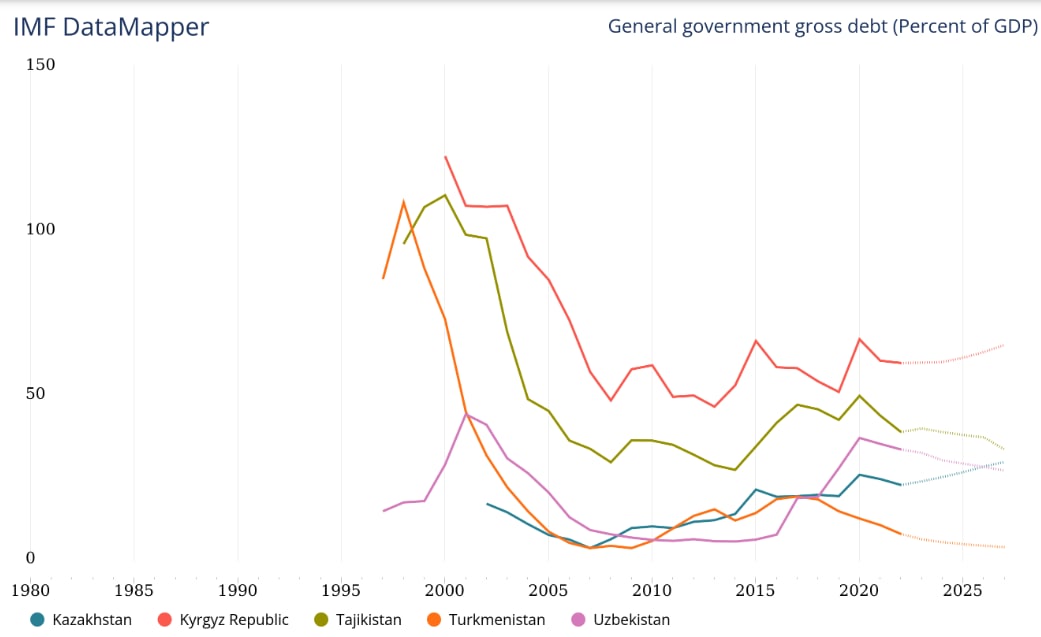

As mentioned above, China's share of foreign debt of Kyrgyzstan and Tajikistan in 2020 was 45 and 52 percent, respectively. This corresponds to the equivalent of more than 20% of their gross domestic product.

In 2011, it was reported that the China Development Bank allocated $8.1 billion in loans for projects in Turkmenistan. The Turkmen side reported that these debts were paid in full, but due to the confidentiality of the contracts, it was not disclosed how the money was returned. According to some sources, the infrastructures built by China are very expensive for Turkmenistan, and gas may be supplied to China for free or preferentially. It is impossible to know how much China is paying for Turkmen gas, these numbers are not disclosed to the public as a “trade secret”.

Kazakhstan’s external debt is significantly higher than that of other countries in the region. As of June 1, 2022, this figure was $164.2 billion. But China’s share in the total foreign debt is 6.5-7%. In May 2021, Kazakhstan’s legislation was amended to prohibit the sale of agricultural land in the country to foreigners and foreign companies. This change is also explained by the growing sentiment of protest against China in the country.

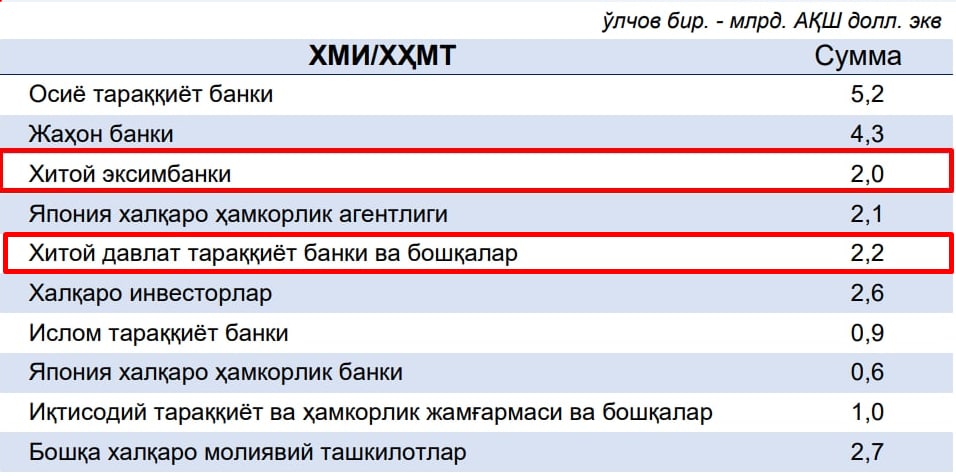

According to the information given by the Deputy Minister of Finance of Uzbekistan, Odilbek Isakov, as of July 1, 2022, the total state debt of Uzbekistan is $25.9 billion, of which $23.2 billion is the state’s foreign debt.

As of January 1 of this year, the distribution of the public external debt of Uzbekistan in terms of creditors is as follows:

We can see that China Exim Bank and China State Development Bank are among the main creditors of Uzbekistan. Loans received from these financial organizations made up 17.7% of the total foreign debt of Uzbekistan. International rating agency Fitch Rating confirmed Uzbekistan’s sovereign credit rating at a stable, unexpected level in its latest report. As a dangerous situation for Uzbekistan, we can mention the increasing debt dependence of Kyrgyzstan and Tajikistan on China. Many strategic objects built and under construction in these countries are also very important for the vital interests of Uzbekistan.

Related News

14:55 / 10.02.2026

British operator launches $50,700 luxury Silk Road train from Beijing to Tashkent

12:55 / 10.02.2026

Islamic Development Bank to fund $164m in infrastructure and education projects in Uzbekistan

12:46 / 09.02.2026

Uzbekistan launches $50m fund to boost industrial cooperation and SME growth

12:44 / 09.02.2026