“38 percent of entrepreneurs intend to obtain resources through Islamic finance” – President

President Shavkat Mirziyoyev announced that a new draft law on Islamic finance has been prepared. Once adopted, this law will allow banks to operate using Islamic finance principles, potentially leading to an additional $5 billion in resources.

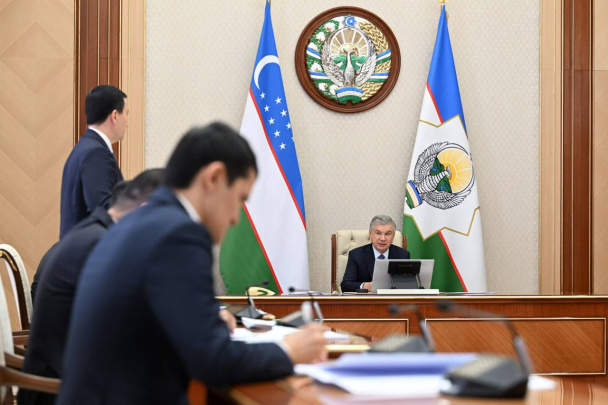

Photo: Presidential press service

In surveys conducted among entrepreneurs, 38 percent expressed a desire to obtain resources based on Islamic finance principles.

This was revealed during a public dialogue with entrepreneurs, where President Shavkat Mirziyoyev also mentioned that last month, microfinance institutions were authorized to provide services based on Islamic terms.

“If the prepared draft law is adopted, banks will also be able to operate under Islamic finance principles. This will spur the provision of new financial services, attract many investors, and generate an additional $5 billion in resources,” said the president.

Earlier, Behzod Hamroev, Deputy Chairman of the Central Bank, announced that the draft law on Islamic finance has been developed and is expected to be submitted to Parliament by the end of the year.

Hamroev also noted that if our basic laws are finalized by 2024, there will be both demand and conditions for these services to become widespread in other banks.

Islamic Finance in Uzbekistan

Since 2017, Uzbek officials have been discussing the introduction of Islamic economic management and Islamic financial institutions to develop the banking sector and external trade.

For the development of small and medium-sized businesses, the Silk Road Bank has attracted funds from the Islamic Development Corporation: $2 million in 2006, $5 million in 2010, and $14 million in 2017.

From July 2018, two more banks, Trustbank and Infibank, began financial cooperation with the Islamic Development Corporation. Shortly after, the Islamic Development Corporation signed Sharia-compliant financial agreements with six institutions in Uzbekistan: Kapitalbank, Asakabank, Turonbank, Hamkorbank, Uzsanoatqurilishbank, and Asia Alliance Bank.

In 2021, Central Bank Chairman Mamurizo Nurmurodov announced plans to open Islamic banking branches.

From September 1-4, 2021, Tashkent hosted the 46th Annual Meeting of the Islamic Development Bank Group Board of Governors. At the summit, 30 financial agreements totaling $1.2 billion were signed between the IDB Group and ten member countries. Of this, $330 million was agreed to be allocated for Uzbekistan’s interests.

During the IDB Group meeting, the Economic Opportunities Expansion Fund for Uzbekistan was established, and the IDB’s payment system was launched.

In 2022, Uzbekistan established cooperation with the prestigious international organization for Islamic finance institutions, the Accounting and Auditing Organization for Islamic Financial Institutions.

Additionally, the law “On Non-Bank Credit Organizations and Microfinance Activities,” signed on April 20, 2022, allows microfinance institutions to provide loans based on Islamic finance principles.

The "Uzbekistan-2030" strategy, approved in September 2023, envisions the implementation of Islamic finance standards and procedures in at least three commercial banks.

In a March 2023 interview with Kun.uz, Khaine Salem Sonbol, Executive Director of the International Islamic Trade Finance Corporation, stated that the corporation has allocated $750 million to develop Islamic finance in Uzbekistan and is prepared to continue supporting the country in this area.

Related News

14:54 / 03.03.2026

Users must now declare purpose for all card-to-card transfers under new Central Bank rules

14:15 / 25.02.2026

Uzbekistan’s public debt rises 16.5% year on year to $46.8bn

12:50 / 21.02.2026

President Mirziyoyev backs extension of tax relief to accelerate Karakalpakstan’s industrial growth

20:24 / 20.02.2026