Chevrolet’s share declines as BYD and KIA post strong growth in Uzbekistan’s car production in 2025

Uzbekistan produced 457,900 passenger cars in 2025, marking a 6.7% increase compared with the previous year, according to data from the National Statistics Committee. Despite overall growth, production of several mass-market Chevrolet models declined, while Chinese and other foreign brands recorded rapid expansion, reshaping the country’s automotive landscape.

Photo: KUN.UZ

Total passenger car output rose from 429,100 units in 2024 to 457,900 in 2025. However, production at UzAuto Motors fell for several of its most popular models. Output of the Cobalt declined by 2.3% to 161,200 units, Damas by 8.1% to 93,700 units, and Onix by 20.5% to 33,100 units. Production of the Gentra model was discontinued in 2025, after 12,800 units were produced in 2024.

At the same time, several models and brands posted notable growth. Production of the Tracker increased by 9.7% to 50,400 units. Output of KIA vehicles rose by 19.3% to 26,300 units, while Chery production grew by 32% to 9,354 units. Haval recorded nearly a threefold increase, from 3,315 to 9,344 units. KIA, Chery, and Haval vehicles are produced at the ADM Jizzakh plant in Jizzakh region.

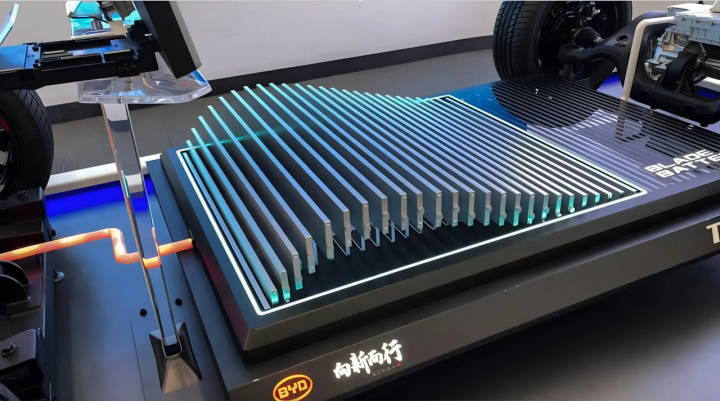

The most significant growth was registered by BYD, whose factory in Jizzakh region increased production more than fivefold, from 4,004 vehicles in 2024 to 20,200 units in 2025.

In addition, 50 units of the Tank 500 model, produced under China’s Great Wall Motors brand, were assembled in Uzbekistan in 2025, compared with zero production a year earlier. By contrast, no LADA vehicles were produced during the year, after six units were assembled in 2024.

Production of specialized vehicles such as the Chevrolet Labo and Wuling N111 more than doubled, rising from 25,500 to 54,300 units. In 2025, sales of the Labo alone reached 37,400 units. Overall, production of designated Chevrolet models, excluding the Labo, declined by 7.9%.

As a result of lower production and sales volumes, Chevrolet’s market share fell from 87.9% in 2024 to 83.2% in 2025, while Chinese and other foreign brands continued to expand their presence.

Imports also reflected shifting trends. Total imports of vehicles, including spare parts and nearly complete cars, amounted to $3.7 billion, up 10.4% year on year. Imports of passenger cars totaled $1.2 billion, down 8.1%, while imports of spare parts and completely built-up (CBU) vehicles rose by 34.4% to $1.7 billion.

Uzbekistan imported 79,822 passenger cars in 2025, up 7.1% from 74,505 units in 2024. However, the total value of passenger car imports fell by 8%, from $1.28 billion to $1.17 billion.

Gasoline-powered car imports declined by 40%, while deliveries of electric vehicles increased 2.4 times. As a result, the share of electric vehicles in total imports surged from 32% to 71%, while the share of internal combustion engine vehicles fell from 44% to 25%. Between January and September, more than 90% of imported passenger cars were supplied from China.

Related News

16:48 / 13.02.2026

Uzbekistan aims to boost car production to 510,000 units annually

11:53 / 12.01.2026

Uzbekistan plans to boost passenger car production to nearly 1 million by 2030

21:18 / 04.12.2025

Uzbekistan to launch new car production plant in Syrdarya with Chinese partners

19:32 / 26.11.2025