Uzbekistan’s currency gains nearly 7% against dollar, easing external debt payments

The strengthening of the UZS in 2025 helped reduce external debt servicing costs by 6–7%, the Central Bank reported in its annual review of the domestic currency market.

According to the report, the appreciation of the national currency boosted confidence in the UZS and contributed to broader economic trends, including accelerated dedollarization and lower inflation expectations. Deposits in UZS rose by 44% over the year, reaching UZS 240 trillion in the banking system.

Inflation expectations among the public fell from 14.4% at the beginning of 2025 to 11.5%, while business expectations dropped from 13.9% to 11.1%. The impact of exchange rate fluctuations on expectations decreased by half during the year.

The pace of dedollarization also accelerated: the share of foreign currency in loans declined from 41% to 38%, and in deposits from 26% to 22%. At the same time, the total volume of foreign currency sold by clients to banks grew by 35%, reaching $47 billion.

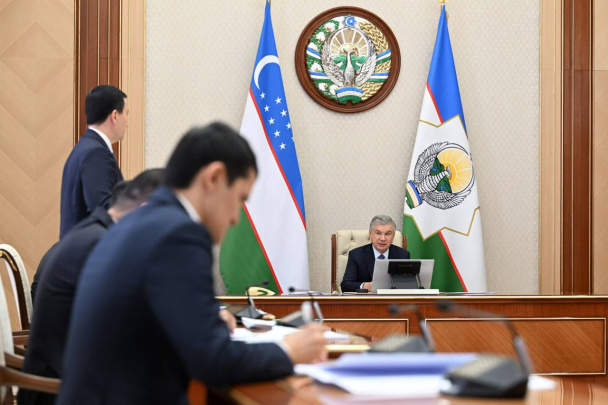

The Central Bank noted that these developments helped lower the average cost of servicing government and corporate external debt to between 6% and 7%. In October 2025, Central Bank Chairman Timur Ishmetov stated that the strengthening sum reduced government external debt servicing costs by 1.3 trillion sums and corporate debt servicing by UZS 3.6 trillion.

Despite a minor depreciation of over 1% in December, the Uzbek sum appreciated by 6.93% against the U.S. dollar over the year, gaining nearly UZS 900. By the end of 2025, the dollar settled slightly above UZS 12,000.

Related News

14:54 / 03.03.2026

Users must now declare purpose for all card-to-card transfers under new Central Bank rules

14:15 / 25.02.2026

Uzbekistan’s public debt rises 16.5% year on year to $46.8bn

16:00 / 23.02.2026

How to check debt with the Enforcement Bureau (MIB) in Uzbekistan

12:50 / 21.02.2026