Қўшимча функционаллар

-

Тунги кўриниш

Swiss court orders Ernst & Young to release audit files in Gulnara Karimova-linked bankruptcy

A long-running legal battle surrounding the collapse of Zeromax, once one of Uzbekistan’s largest conglomerates, has taken a dramatic turn. The Swiss Federal Supreme Court has ordered Ernst & Young (EY) Switzerland to hand over extensive audit-related documents to Zeromax’s creditors – a move that could expose the auditing giant to major reputational damage and potentially billion-dollar penalties.

Photo: Yves Forestier (Getty Images)

The decision marks a key milestone in one of Switzerland’s largest bankruptcy cases, second only to the Swissair collapse, and in a legal saga often described as a “financial thriller around Uzbekistan’s ‘princess’ Gulnara Karimova.”

Five-year legal battle

The case, which has been ongoing for five years, accuses EY Switzerland of overlooking questionable transactions and issuing a clean bill of health for Zeromax’s financial reports, thereby misleading creditors about the company’s solvency. The auditors allegedly failed to flag suspicious dealings tied to Karimova, the daughter of Uzbekistan’s late President Islam Karimov, and her associates.

By July 2025, creditors achieved a major breakthrough when Switzerland’s top court upheld earlier rulings obligating EY to disclose a wide range of audit documents to the plaintiffs. The ruling strengthens the creditors’ position in their pursuit of damages that could reach $1 billion.

According to the Quinn Emanuel law firm, which is representing the plaintiffs, the decision establishes a new legal precedent for auditor liability in Switzerland, where such accountability has traditionally been limited.

From empire to bankruptcy

Founded in Delaware in 1999 and later moved to Zug, Switzerland, Zeromax became one of Uzbekistan’s largest business empires, operating across textiles, construction, and energy. At its height, it reportedly controlled assets equivalent to up to 10 percent of Uzbekistan’s GDP.

However, following political changes in Tashkent, the conglomerate collapsed in 2010. Its Uzbek assets were seized by the state, and its bankruptcy filings in Switzerland listed $2.56 billion in assets against $4.12 billion in liabilities. Subsequent investigations revealed assets worth only 6.66 million Swiss francs, while 191 creditors claimed a total of 5.6 billion francs — making it Switzerland’s second-largest insolvency on record.

The creditors ranged from small service firms in Zug and interior design companies involved in Tashkent’s Forum Palace, to major oil and gas contractors and even Brazilian football star Rivaldo, who claimed Zeromax owed him 22.7 million francs for his 2008 contract with Bunyodkor FC.

EY’s role under scrutiny

Despite mounting red flags, EY Switzerland had audited Zeromax from 2005 to 2007, issuing clean opinions each year and continuing to serve as auditor until 2010 — though the last three audit reports were never published. Investigations revealed that during this period, Zeromax financed lavish personal purchases, including at least $38 million in luxury jewelry, among them a $2.5 million diamond ring by Boucheron found in Karimova’s Geneva bank safe.

In 2019, the U.S. hedge fund Lion Point Capital purchased Zeromax’s creditor claims and, through its Swiss subsidiary Piodina AG, sued EY Switzerland for allegedly misleading investors and creditors.

Following multiple appeals, the Swiss Federal Supreme Court ruled in July 2025 that EY must disclose all physical and electronic records related to Zeromax GmbH’s audits and pay 25,000 francs in court costs plus 30,000 francs in compensation to the plaintiffs. EY has said it will comply with the decision.

The plaintiffs, represented by Quinn Emanuel, described the outcome as a “landmark victory” that could redefine corporate accountability in Switzerland’s financial sector.

Мавзуга оид

21:18 / 12.11.2025

Гулнора Каримова атрофидаги молиявий триллер: Zeromax кредиторлари судда муҳим ютуққа эришди

20:01 / 20.05.2022

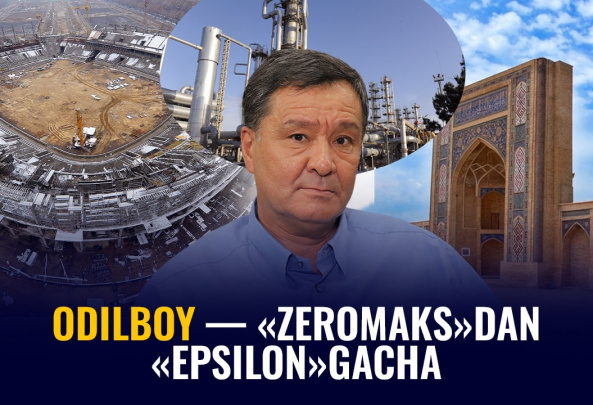

Зеромакснинг тугатилиши, Бунёдкор лойиҳаси, Эпсилон ва Ўзбекистоннинг газ захиралари — “Одилбой” (Миродил Жалолов) билан катта суҳбат

07:46 / 11.09.2021

2,5 млн долларлик олмос узук ва бошқалар: Zeromax харидлари ва босим остидаги Ernst & Young

11:17 / 15.03.2019