New financial technology companies to appear in Uzbek markets

The Central Bank will expand financing for small businesses, strengthen consumer rights protection for financial services, and increase the financial literacy of the population and entrepreneurs.

The Central Bank approved the National Strategy for Increasing Financial Accessibility for 2021-2023, the press service of the regulator reports.

World Bank experts, who were involved in the process of preparing the document, assessed the level of financial literacy in the republic.

Within the National Strategy, coverage of the country’s residents with financial services will be increased in the coming years. They will do this by expanding bank service points, introducing alternative methods of providing banking services and creating a network of banking agents.

Specialists will also develop digital financial services - they decided to start by creating conditions for new financial technology companies to enter the market, introducing a remote identification system and modernizing the national payment system.

Funding of small businesses will be increased through the development of specialized instruments aimed at subsidizing entrepreneurial projects and developing the activities of non-bank loan organizations. Uzbekistan will also strengthen the protection of the consumer rights for financial services: all information about money products and services will be transparent. At the same time, additional mechanisms for resolving complaints and disputes will be introduced.

Also, the media will be involved in increasing the financial literacy of the population and entrepreneurs, while general education institutions and non-economic educational institutions will launch a “Financial Literacy” training program.

Related News

14:15 / 25.02.2026

Uzbekistan’s public debt rises 16.5% year on year to $46.8bn

12:50 / 21.02.2026

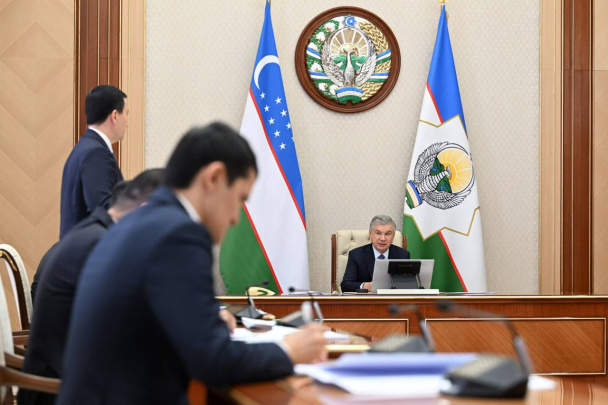

President Mirziyoyev backs extension of tax relief to accelerate Karakalpakstan’s industrial growth

20:24 / 20.02.2026

Central Bank survey shows downward trend in public inflation expectations

18:00 / 18.02.2026