Grey salary: How you lose money on holidays, sick leave and pensions

You have just started a new job. On payday, the accountant hands you an envelope with cash. Everything seems fine: you have your money in hand, ready to spend. But after a few months, you start to notice that something isn’t right.

Here is why grey wages don’t actually help you earn more, instead, they deprive you of money, rights, and long-term security.

What is a grey salary and how does it work?

A grey salary is when a company officially pays you the minimum amount (usually UZS 1–2 million) and gives the rest in cash, “off the books.” The employment contract specifies one figure, but you actually receive more.

Typically, the employer signs a contract stating the minimum salary, often at the legal minimum wage. From that amount, they withhold 12% income tax and pay around 25% in social contributions (Article 258 of the Tax Code). The rest is handed to you in cash – without taxes, deductions, or any official record.

Legal basis:

Article 258 of the Tax Code of Uzbekistan: The income tax rate is set at 12 percent, unless otherwise provided in Chapter 36 of the Code.

Article 371 of the Tax Code: Income in the form of remuneration covers all benefits payable to an employee, including salaries, bonuses, incentives and compensatory payments.

Why it is dangerous

The employer is legally required to withhold 12% income tax from your official salary and transfer it to the state budget. In addition, they must pay roughly 25% in social contributions from the total payroll fund – the money that determines your pension, sick pay, and other entitlements.

When part of your salary is paid in cash “off the books,” no contributions are made on that portion. This means your pension won’t grow, vacation and sick pay will be lower, and you won’t be able to confirm your income when applying for a loan, visa, or social benefits.

Example: You were promised UZS 5 million, but your contract lists UZS 1.5 million. Taxes are paid only on that amount. The remaining UZS 3.5 million is paid in cash – officially, it doesn’t exist.

On paper, everything looks legal: formally, you’re earning the minimum wage. But in reality, this is a classic tax evasion scheme – at your expense.

How a grey salary eats into your money

The most unpleasant surprise comes when you decide to take a vacation (minus UZS 3.3 million for one leave).

According to Article 257 of the Labor Code (as amended on February 13, 2025), vacation pay is calculated based on your average official salary over the last 12 months.

Formula (Article 257, Part 8):

Average daily salary = Average monthly salary ÷ 25.3

Vacation pay = Average daily salary × Number of vacation days

Only the salary officially recorded in documents is included. The “envelope” portion isn’t counted at all.

Example: You have worked for a year. Your official salary is UZS 1.5 million, and you receive another UZS 3.5 million in cash. In total, you earn UZS 5 million per month.

You take 28 days of vacation.

- Expected vacation pay: (UZS 5,000,000 ÷ 25.3) × 24 working days = UZS 4,743,000

- Actual vacation pay: (UZS 1,500,000 ÷ 25.3) × 24 = UZS 1,423,000

- Loss: about UZS 3.3 million

How employers handle it

There are several common scenarios:

- Some employers pay the grey portion of your vacation separately – but this is rare.

- Others don’t pay it at all, or only pay the minimum.

- Some simply say: “Your contract says UZS 1.5 million – that’s what you’ll get.”

What you can do

Before planning your leave, check with colleagues how vacation pay is handled in your company. Try to negotiate with management, but be prepared that you might not receive the full amount.

Hospitals: You lose a million every time you fall ill

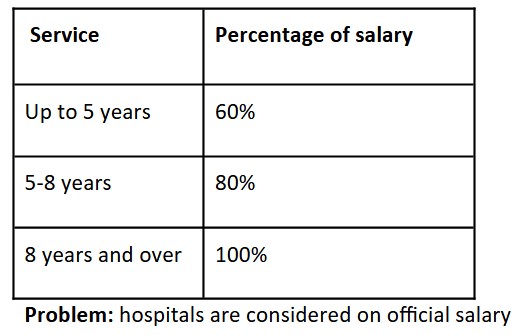

If you fall sick and take medical leave, you are entitled to a temporary disability allowance (Article 286 of the Labor Code). The amount depends on your length of service (Annex 1 to the Decree of the Cabinet of Ministers dated May 31, 2024, No. 314).

Example: You have the flu, and your doctor prescribes 10 days of sick leave (from February 1 to 10). You have worked for nine years, so you are eligible for 100% of your average salary.

- Official salary: UZS 1.5 million

- Actual salary: UZS 5 million

Expected payment: (UZS 5,000,000 ÷ 25.3) × 8 working days (6-day week) × 100% = UZS 1,581,000

Actual payment: (UZS 1,500,000 ÷ 25.3) × 8 × 100% = UZS 474,000

Loss: approximately UZS 1.1 million – for just one illness.

The same applies to maternity benefits

Maternity benefits are also calculated based on your official (white) salary (Article 281 of the Labor Code). If you are planning to have a child, be prepared that the amount of maternity and childcare benefits will be far less than expected.

The allowance for childcare up to two years old is calculated using the same formula (Regulation No. 1113, registered on March 14, 2002).

What you can do: Ask your colleagues how sick pay is handled. Discuss all the details with your employer in advance. The company may sometimes compensate the difference informally, but in practice, that rarely happens.

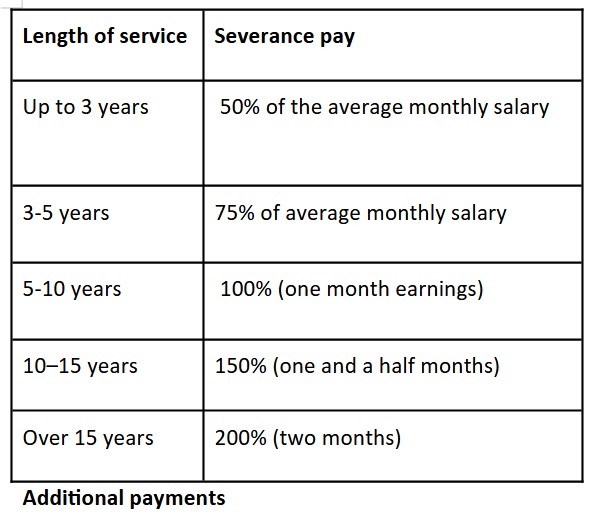

Dismissal: loss of UZS 10.5 million

If your company reduces staff or liquidates, you are entitled to severance pay (Article 173 of the Labor Code). The amount depends on your length of service.

If you don’t find a new job after dismissal, you are also eligible for additional payments (Article 100 of the Labor Code):

- For the second month after dismissal – another average monthly salary (if you are still unemployed).

- For the third month – another average monthly salary (if you are registered at the employment center).

However, all these payments are calculated based only on your official salary.

Example: You have worked for eight years. Your official salary is UZS 1.5 million, while your actual salary is UZS 5 million.

Expected payments:

- Severance pay – UZS 5,000,000

- Second month without work – UZS 5,000,000

- Third month (registered at the employment center) – UZS 5,000,000

- Total expected: UZS 15,000,000

Actual payments:

- Severance pay – UZS 1,500,000

- Second month – UZS 1,500,000

- Third month – UZS 1,500,000

- Total received: UZS 4,500,000

Loss: approximately UZS 10.5 million

Even worse: dismissal “of your own accord”

In some companies that pay low official salaries, employees are pressured to sign a resignation letter “of their own accord.” In this case, no severance pay is provided at all.

You sign the letter – and you walk away with nothing.

Pension: minus UZS 2.1 million every month for life

Your future pension is based on social contributions that the employer pays from your official salary (Law of the Republic of Uzbekistan “On State Pension Provision for Citizens,” dated September 3, 1993, No. 938-XII).

When part of your salary is hidden, no contributions are made from that portion – and your pension will be much lower.

How much the employer actually pays

- Social tax – 12% of the payroll fund. This money goes to the Social Fund and contributes to your future pension.

- Insurance contributions – 7%. These are deducted from your salary and also go toward your pension savings.

- Contributions to the savings system (INPS) – 0.1%. This amount is credited to your personal pension account.

The problem: All these contributions are calculated only from your official salary. The money you receive “in an envelope” is not counted anywhere.

How your pension is calculated

The size of your state pension depends on your length of service and the average salary from which contributions were paid (Article 26 of the Law “On State Pension Provision”).

Formula:

Basic pension = Average salary × 55%

Seniority allowance = Average salary × 1% × (Years beyond the minimum length of service)

Final pension = Basic pension + Seniority allowance

Example: You have worked for 30 years. Your official salary during that time is UZS 1.5 million, while your actual salary is UZS 5 million.

Expected pension (if all contributions were paid):

- Base: UZS 5,000,000 × 55% = UZS 2,750,000

- Seniority bonus: UZS 5,000,000 × 1% × 5 years = UZS 250,000

- Total expected pension: UZS 3,000,000 per month

Actual pension (based on official salary):

- Base: UZS 1,500,000 × 55% = UZS 825,000

- Bonus: UZS 1,500,000 × 1% × 5 years = UZS 75,000

- Total received: UZS 900,000 per month

Difference: about UZS 2.1 million every month – for the rest of your life.

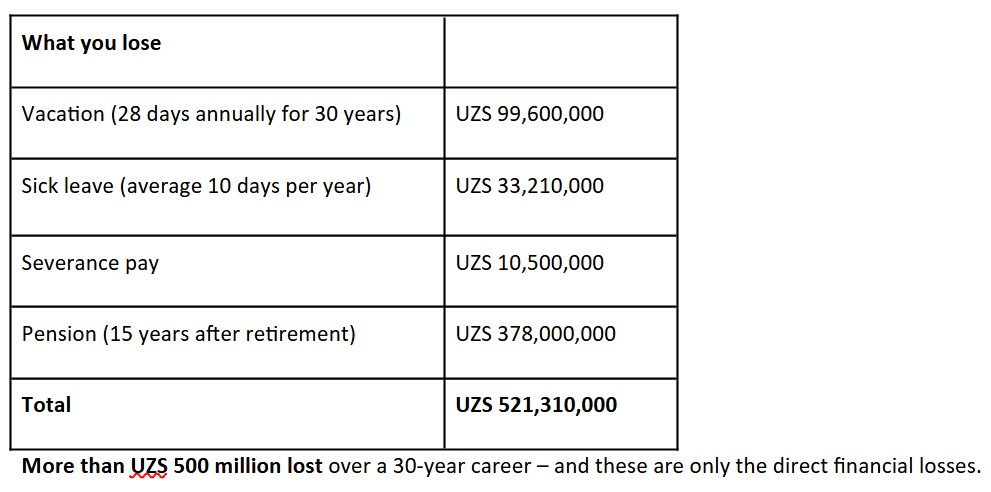

What it means in numbers

If you live at least 15 years after retirement, you will lose:

UZS 2,100,000 × 12 months × 15 years = UZS 378,000,000

That’s nearly UZS 400 million lost – simply because the employer paid contributions only on the official portion of your salary.

The total bill: How much you lose over a lifetime

Let’s take an example of a person who worked for 30 years with an official salary of UZS 1.5 million and a real salary of UZS 5 million:

This doesn’t include:

- The inability to get a mortgage or bank loan

- Visa complications

- Lack of social protection and benefits

Legal risks: Who is held responsible

Who bears the main risk?

Formally, the tax agent is the employer – it is their duty to calculate, withhold, and transfer income tax (Article 23 of the Tax Code). However, under the law, the taxpayer remains the employee. If taxes are not paid, both parties may be held liable.

Legal basis:

- Article 23 of the Tax Code: Tax agents are responsible for calculating, withholding, and transferring taxes to the budget.

- Article 346 of the Tax Code: If the tax is not withheld, the tax agent must pay the unpaid amount and the related penalties.

What it means for the employee

An employee who agrees to receive a salary “in an envelope”:

- Formally accepts participation in an illegal scheme

- Loses pension savings due to unpaid contributions

- Forfeits social guarantees, such as sick leave, vacation pay, and benefits

- Cannot prove income when applying for loans, visas, or state subsidies

If a dispute arises — for example, over unpaid dismissal compensation – it will be extremely difficult to prove your actual earnings, since they are not documented anywhere.

If a criminal case is opened against the employer, you may also be questioned for your involvement in the scheme. In theory, an employee could even be prosecuted under Article 184 of the Criminal Code, which provides for a penalty of up to one year of imprisonment.

What the employer faces

Article 184 of the Criminal Code – “Tax evasion”

- Part 1: imprisonment for up to 2 years (for amounts between UZS 33 million and UZS 99 million)

- Part 2: up to 3 years (for amounts from UZS 99 million to UZS 165 million)

- Part 3: up to 5 years (for amounts exceeding UZS 165 million)

Managers, chief accountants, and business owners are most often subject to criminal liability under these provisions (Decision of the Plenum of the Supreme Court No. 8, dated May 31, 2013).

Article 184¹ of the Criminal Code – “Violation of budgetary and budgetary-staff discipline”

- For large-scale violations: a fine of up to 50 BCU or community service for up to 240 hours

- For particularly large-scale violations: a fine from 50 to 75 BCU, corrective labor for up to 2 years, or imprisonment for up to 1 year

What to do if you are already receiving an unofficial salary

Step 1. Talk to your employer

Ask to have your salary formalized. Explain that you need an official (“white”) salary for a loan, mortgage, or simply for financial security. Some employers may agree, especially if you are a valued employee.

Step 2. If the employer refuses – start looking for another job

This is especially important if you plan to:

- Buy an apartment or a car

- Have a child

- Build long-term savings or rely on a future pension

Step 3. Protect yourself legally

If your employer forces you to work “off the books,” file a complaint – this will prove that you were not voluntarily participating in the illegal scheme.

- Submit a report to the State Tax Committee

- Indicate that your employer is evading taxes and social contributions.

- You can submit the complaint through the online portal my.soliq.uz.

- File a complaint with the State Labour Inspectorate

- This can be done online via dmi.mehnat.uz, by calling 1176, or through the Telegram bot @mehnathuquqbot.

- Keep all evidence

- Save correspondence, payment records, and work schedules.

- If an investigation begins, these documents will prove that you did not willingly participate in the scheme.

What to include in your complaint:

Clearly state that your employer is evading taxes and failing to make required social contributions. Attach all available evidence – messages, payment receipts, and records of working hours. These will support your case if the authorities initiate a review.

If you are looking for a new job

- Read the employment contract carefully.

- The full salary must be stated in the contract. If one figure appears in the document and another is promised verbally, treat it as a red flag.

- Ask future colleagues.

- If possible, discreetly find out from current or former employees how salaries are actually paid. You can also check through social networks or acquaintances.

- Check the company’s reputation.

- Read reviews on job search websites. A pattern of complaints about non-payment or grey schemes is a serious warning sign.

Legal basis

- All data in the article are based on current legislation of Uzbekistan:

- Tax Code (Law ZRSU-599 of 30.12.2019): lex.uz/ru/docs/4674893

- Labor Code (Law OBU-798 of 28.10.2022): lex.uz/docs/6257291

- Criminal Code (Law 2012-XII of 22.09.1994): lex.uz/ru/docs/111457

- Administrative liability code: lex.uz/docs/97661

- Law “On the state pension scheme”: lex.uz/acts/112312

- Ruling of the Plenary of the Supreme Court 8 of 31.05.2013: lex.uz/docs/2212247

This material is for informational purposes only and does not constitute legal advice. In case of dispute, please consult a qualified lawyer.

Related News

18:00 / 18.02.2026

Inflation expectations in Uzbekistan drop to 11.2% as January optimism returns

17:38 / 02.02.2026

Migration and uneven development widen regional income divide in Uzbekistan

14:19 / 27.01.2026

Average monthly wage in Uzbekistan rises to UZS 6.38 million

20:26 / 13.01.2026